Artículos Científicos

DERIVATIVES AND ECONOMIC GROWTH: LINKS AND EVIDENCE THE IMPACT OF THE FINANCIAL DERIVATIVES ON THE REAL ECONOMY

DERIVADOS Y CRECIMIENTO ECONÓMICO: NEXOS Y EVIDENCIA EL IMPACTO DE LOS DERIVADOS FINANCIEROS EN LA ECONOMÍA REAL

DERIVATIVES AND ECONOMIC GROWTH: LINKS AND EVIDENCE THE IMPACT OF THE FINANCIAL DERIVATIVES ON THE REAL ECONOMY

Ciencias Administrativas, núm. 16, 2020

Universidad Nacional de La Plata

Recepción: 19 Junio 2019

Aprobación: 04 Octubre 2019

Abstract: This paper studies the links between the development of derivative markets and economic growth. By acknowledging the shortness of samples hindering any robust econometric analysis, it sets out and empirically checks those links, adopting statistical correlation techniques. It uses developed and emerging economy data over the most extensive period possible and tests for the presence of a structural break after the 2008-2009 crisis. The general result is that derivatives are positively correlated with economic growth, in particular, through the investment and international trade links. Another general result is that there is a concave relationship between growth and derivatives in the case of developed countries.

Keywords: derivatives, developed markets, economic growth, emerging markets.

Resumen: Este trabajo estudia el nexo entre el desarrollo de los mercados de derivados y el crecimiento económico. Reconociendo que la falta de datos obstaculiza cualquier análisis econométrico robusto, este trabajo establece y verifica empíricamente esos nexos adoptando técnicas de correlación estadística utilizando datos de los mercados desarrollados y emergentes durante el período más grande posible y prueba la presencia de un quiebre estructural después de la crisis del 2008-2009. El resultado general es que los derivados están correlacionados positivamente con el crecimiento económico, en particular a través del canal de inversión y comercio internacional. Otro resultado es que dicha relación es cóncava entre el crecimiento y los derivados en el caso de los países desarrollados.

Palabras clave: derivados, mercados desarrollados, crecimiento económico, mercados emergentes.

Introduction and objectives

There is vast and robust evidence that financial sector development affects economic growth for various samples across countries or regions, both at the industry and firm levels and over different time spans, typically starting in 1960 (Levine & Zervos, 1996 and 1998; Levine, 2004; Rousseau & Wachtel, 2009; Michalopoulos et al, 2009; Hakan, 2011; Cecchetti & Kharroubi, 2012/2015). However, most of the literature researched the impact of the banking and stock market financing on economic growth. This includes the various trade-offs between the financing mix and the long-run growth rate on the one hand, and the bi-causality and vanishing effect after a given financial market development threshold on the other. Less attention has been paid to the theoretical links between financial derivatives and economic performance in the long run, as well as the empirical test of those links. This fact is probably due to the scant empirical observations on these assets´ turnover, market capitalization, and observable pricing data.

In this paper, we ask three questions: What is the theoretical nexus between financial derivatives and economic growth? What is the correlation between the latter given the limited sample size, non-linearities, abnormal distributions of derivative market variables, and inappropriate use of econometric models to research and isolate the effect of financial derivatives on economic growth? Is there any difference between developed and emerging markets?

The objectives of this paper are to contribute to the finance-growth literature in at least three ways:

We argue that fully understanding the impact of derivatives on economic growth requires closing the gap between financial sophistication and the real economy knowledge about the usefulness of derivatives. By combining a financial and economic perspective into the analysis, we expect to make a valuable and novel contribution to the existing literature. At the same time, by establishing the channels through which derivatives can foster economic growth, this paper intends to provide clarity on the challenges and opportunities that financial derivatives imply for firms, industries, and the aggregate economy.

Our central hypothesis is that there is a positive, yet decreasing, relation between financial derivatives and economic growth through the channels we identify and discuss. We argue that after a certain threshold, measured by the derivatives market volume, the positive effects start to vanish in line with Cecchetti & Kharroubi’s view (2012 and 2015) in a broader study on financial development and growth. The analysis is conducted by comparing emerging and developed countries, using these categories as baselines of the size and characteristics of their derivatives and financial markets. We also hypothesize that emerging markets could find it beneficial to exploit this gap with developed markets. Emerging markets, which are assumed to start with a less developed derivatives market, can obtain higher returns than those countries where benefits seem to have exhausted (signal of the decreasing relation between derivatives market size and economic growth).

Theoretical links between derivatives markets and economic growth

Derivatives markets are not a novelty. The futures and options market for tulips in Holland, which goes back to the seventeenth century, is perhaps the clearest and most famous example of these markets and products’ old age. However, derivatives markets have experienced significant growth over the last two decades.

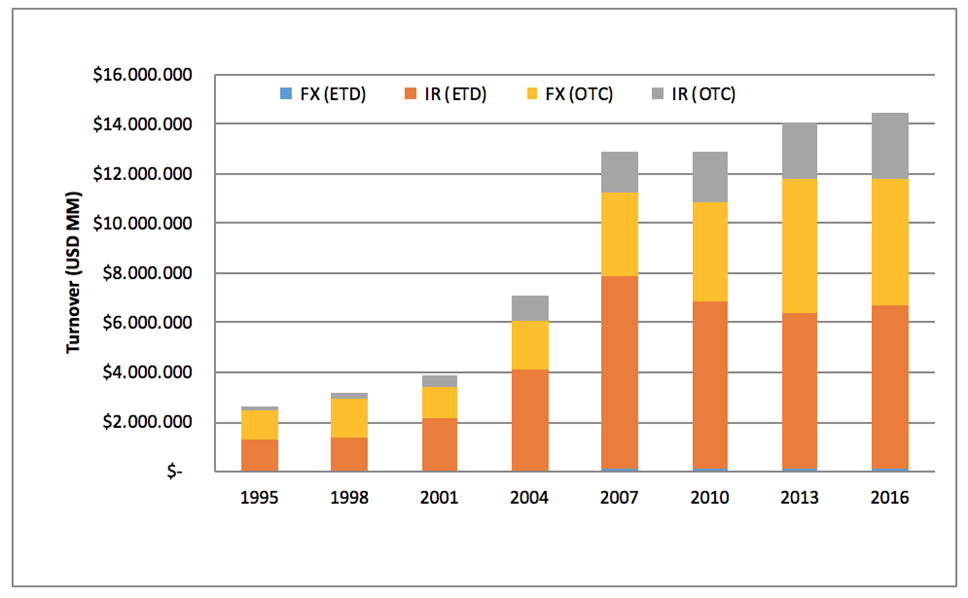

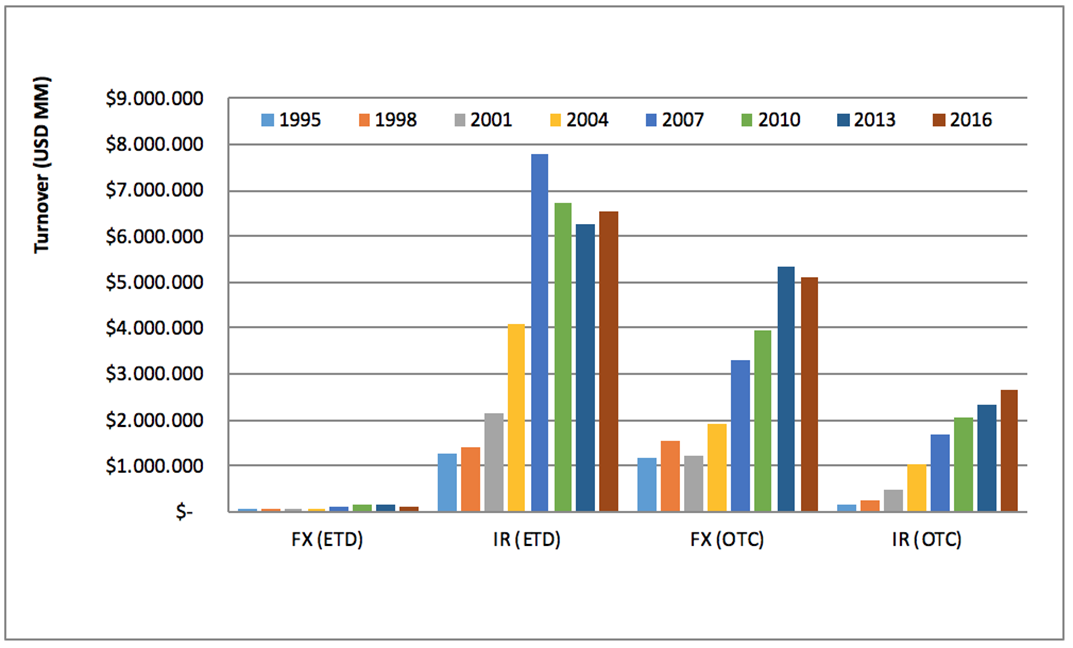

Figures 1 and 2 show the evolution of traded volume, commonly referred to as turnover[1], for interest rate (IR) and foreign exchange (FX) derivatives. It is interesting to differentiate between products traded in regulated markets (Exchange-traded derivatives or ETD) and those commercialized bilaterally (Over the counter or OTC). Considering that turnover is a measure of volume and activity level (Tissot, 2015), we can confirm that both OTC and ETD markets have grown exponentially over the last twenty years. By using turnover as a measure of market size, we can see that the derivatives market grew over 400% between 1995 and 2016. It is worth mentioning an apparent structural break after 2007, which is evident due to the impact of the global financial crisis.

Several reasons explain the exponential growth seen in the derivatives market, among which we can list the increased market liquidity, the heightened volatility, and the financial market deregulation. However, what is the impact of this growth in different economies? What is the nexus between the use of derivatives and economic growth?

To answer our research questions on the relationship between financial derivatives and growth, we can identify at least three channels of transmission through which the use of derivatives may impact the real economy: 1) investment, 2) technical progress, and 3) international trade. Each of these channels can be broken down into sub-channels, which will allow us to isolate the specific elements that are impacted by the use of derivatives and, thereby, influence economic growth, ceteris paribus.

Investment channel

Derivatives can impact three different elements associated with investment: Traditional financing (bank loans), alternative financing (capital markets), and investment incentives. Given their central hedging role, derivatives allow banks to free capital towards credit lines. Derivatives can also reduce earnings volatility by locking up profits and contributing to a firm´s valuation. Finally, by reducing cash flow volatility, derivatives can bring stability and predictability to a firm’s inflows and outflows, encouraging the reinvestment of utilities.

As to the traditional financing sub-channel, Prabha et al. (2014) state that derivatives, by allowing an expansion of credit to the private sector, explained 1.1% of the GDP increase in the United Estates between 2003 and 2012. Yorulmazer (2012) finds a similar connection when he explains that, thanks to the use of derivatives, banks find themselves in a stronger position and are more willing to increase lending. This author also highlights how Credit Default Swaps (CDS) allow banks to free regulatory capital for other uses.

Regarding the alternative financing link, it is important to highlight that proper risk management may have a real and immediate impact on a firm’s financial condition. By using derivatives for hedging purposes, a company may show financial strength and be able to find cheaper financing (Fender, 2000). Love and Zicchino (2006) arrive at a similar conclusion. They claim that the financial structure of firms is a type of collateral that impacts on the external financing availability, which implies that derivatives hedging increases funds availability. Prabha et. al. (2014) also find that non-financial firms experience improvements in their valuations and funding costs thanks to the use of derivatives.

Finally, the third sub-channel is related to investment incentives. Love and Zicchino (2006) find that, in countries with low financial development, firms are highly dependent on internal financing (retained earnings) for their investments. In these cases, derivatives bring certainty and predictability to cash inflows and outflows, increasing the availability of domestic funds. Derivatives also allow firms to achieve cash flows that could not be obtained through other products, improving a firm’s liquidity. Fender (2000) starts with the same assumption and concludes that derivatives encourage investment by reducing the disincentives caused by interest rate volatility.

Technical progress channel

The technical progress channel has an ambiguous impact on economic growth. On the one hand, the risk management benefits associated with derivatives may help to finance long term projects (like most research and development investments). On the other hand, derivatives (and the financial sector growth in general) may have a negative impact on innovation by absorbing the qualified labor force.

From a financial resources perspective, Yorulmazer (2012) posits Credit Default Swaps as a tool that eases the financing of firms and projects of higher credit risk and tenor. Andersen and Tarp (2003) also postulate that the main channel through which the financial system impacts economic growth is the provision of tools designed to transfer risk. The previous analysis carried out for the investment channel also applies here, due to the nexus between investment and technical progress. From a human resources perspective, the impact is the opposite. Considering that the financial industry competes with other sectors for qualified labor force, we can clearly see how this may damper innovation and technical progress. Bodnar and Gebhardt (1998) find that proper derivatives management requires qualified personnel. Cecchetti and Kharroubi (2015) go even further and postulate that the financial industry literally takes scientists away from their investigations.

International trade channel

This channel, specifically the imports and exports of goods and services, is perhaps the easiest to observe. Derivatives are a crucial tool for any company exposed to foreign exchange or commodity price volatility. Not only do they allow exporters and importers to strengthen their financials, but they also reduce the disincentives for international trade.

Regarding this link, Si (2014) finds that foreign exchange derivatives explain 15% of export variability and 20% import volume variability in China. This case is of interest not only due to the size of China in international trade but also because FX derivatives used in China are only approved by regulators under the real need of coverage (preventing speculative use of FX derivatives). This characteristic of the Chinese derivatives market makes it a perfect example of the nexus of derivatives and international trade.

Methodology of investigation

In contrast to other economic and financial variables, data on derivatives is much scarcer. The Bank for International Settlements (BIS) produces the most comprehensive database on derivative markets: The Triennial Survey of Foreign Exchange and Derivative Markets[2]. The turnover values compiled by the BIS offer a measure of market activity and also benefit from two features that make them more valuable to our purpose: 1) turnover values are unconsolidated, which enable us to perform country-wise analysis; and 2) turnover is a flow indicator that captures market volumes and liquidity much better than stock variables. By contrast, there are some disadvantages of using turnover figures, namely, 1) for exchange-traded derivatives, turnover is not reported at a country level, and 2) turnover values reported by the BIS are available for a selected list of countries and years. This is an important issue since it makes it difficult to establish long-run empirical relations and limits severely the possibility of an econometric analysis.

In this paper, only OTC derivative trades are considered in our analysis since they can be associated with specific countries. Then, we combine both interest rate and foreign exchange trade values to obtain a single measure of derivatives turnover per country and year. Finally, we rescale the turnover measure by dividing it into each country-year GDP[3]. This new variable, i.e., turnover as a percentage of GDP, allows for comparison among different countries and prevents any bias associated with exchange rate variability[4].

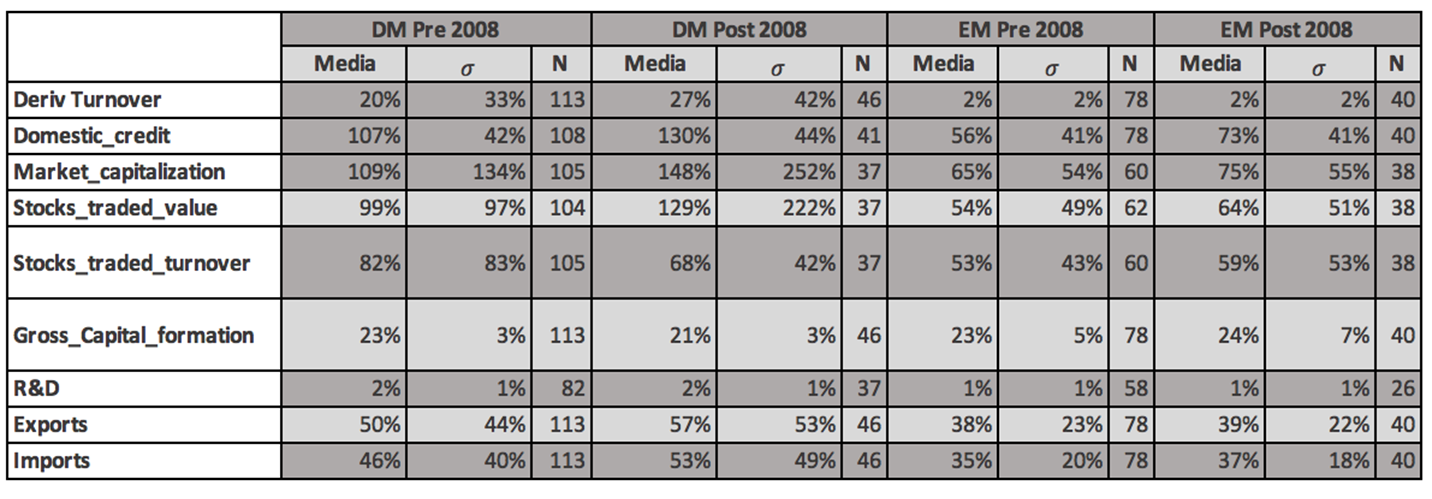

As discussed before, there seems to be a structural break in the series for derivatives turnover after 2007. We build two time series in order to cope with this possible structural break: “Pre 2008” (1995, 1998, 2001, 2004, 2007) and “Post 2008” (2010, 2013). We also divide the data according to the country development and risk status: Developed (DM) and Emerging markets (EM)[5]. As a result, four different groups are available for a total of 277 observations . Finally, to study the three transmission channels stated and defined in Section 2, we compute and interpret the correlation between derivative turnover and GDP ratios with other economic variables that are representative of each channel/sub-channel on a yearly and cross-section basis.

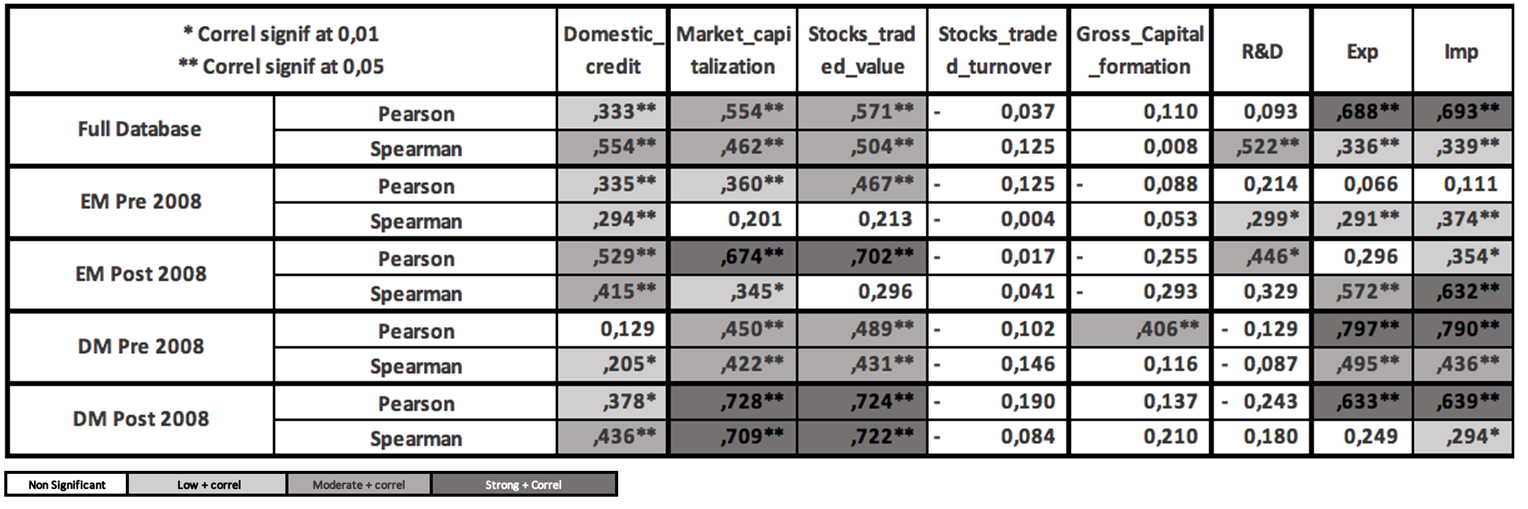

It is worth mentioning that the data availability is not the same among groups and channels. Despite this limitation, there is enough data to proceed with a correlation analysis. The significance of the correlation values is also analyzed to sustain the results. Since the variables analyzed here do not follow the Normal distribution assumptions, we use both the Pearson and Spearman coefficients of correlation and privilege the latter to explain the value and significance of the correlations between each channel and the derivative market turnover. Spearman's coefficient has the advantage of being a non-parametric (distribution-free) coefficient, which makes it suitable for our statistical analysis.

Empirical analysis of the transmission channels

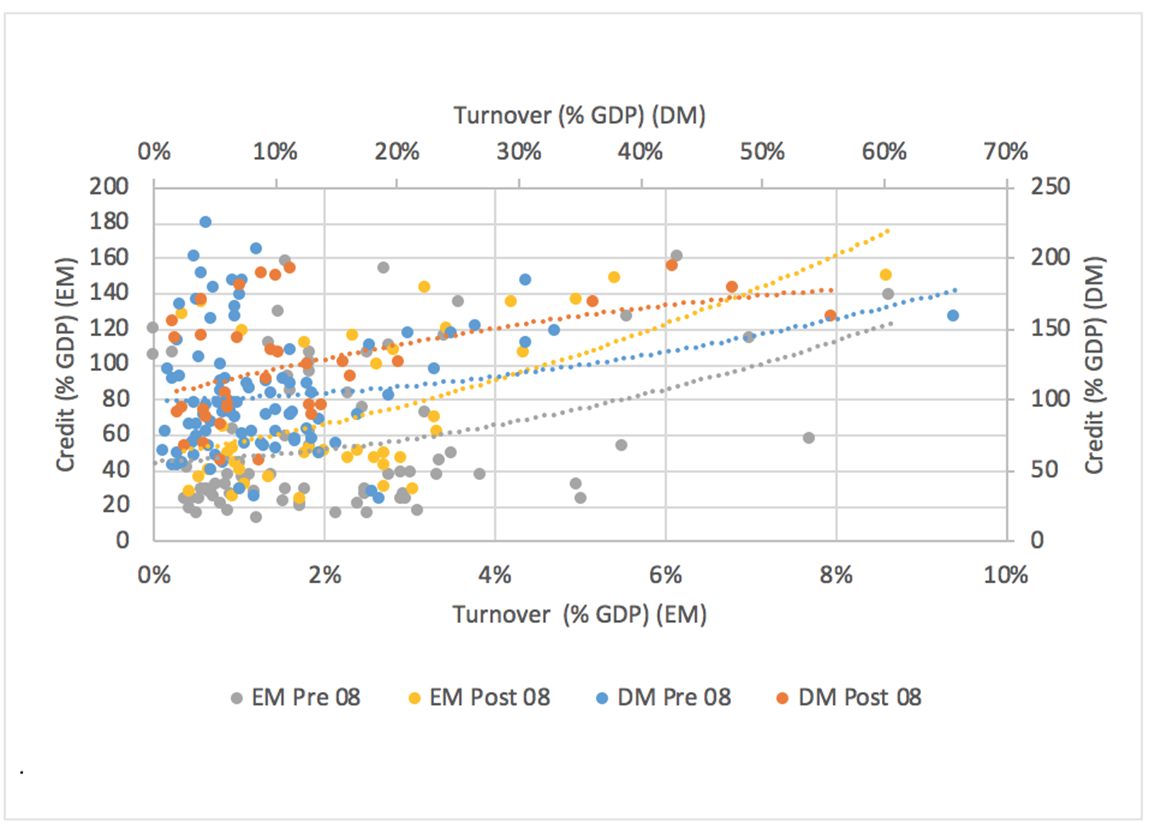

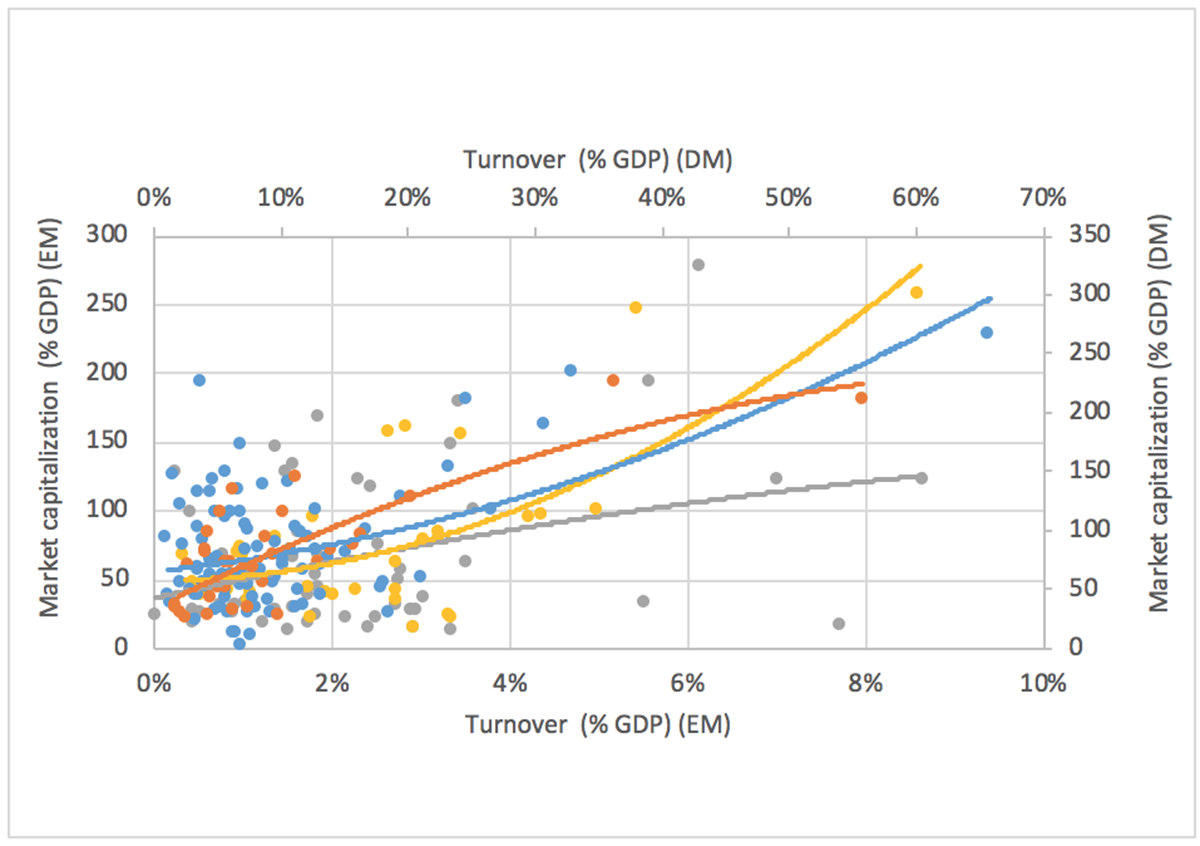

For the sake of reading simplicity, all correlation charts below adopt the same format. The horizontal axis always corresponds to the turnover while the vertical axis varies depending on the channel or sub-channel being tested. On the other hand, the lower and left axis always corresponds to emerging markets, while the upper and right axis corresponds to developed markets. Finally, the shape of the correlation and each dot follow the same color patterns on all the charts:

We can now proceed to the analysis of each channel and sub-channel separately, establishing the proxy variables in each case and their correlation with derivatives turnover to GDP ratios. In all correlation analyses, outliers were removed due to their distortive effect on the shape of the correlations. Outliers correspond to three countries: Singapore, Hong Kong, and United Kingdom[6].

Investment channel

To measure the traditional financing sub-channel, we use the level of credit to the private sector[7]. The correlation between credits to the private sector and derivatives is positive and statistically significant. If we compare the different market segments, we observe a stronger correlation in emerging markets, along with a stronger correlation in both groups post-2008. In Figure 3, we can see that the emerging markets correlation is positive at an increasing rate while developed markets correlate at a decreasing rate. We can conclude that an expansion of the derivatives market might allow emerging countries to deepen their level of financial development and expand the volume of credit. In contrast, this effect is less evident in developed countries, especially in those with high levels of derivatives turnover.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

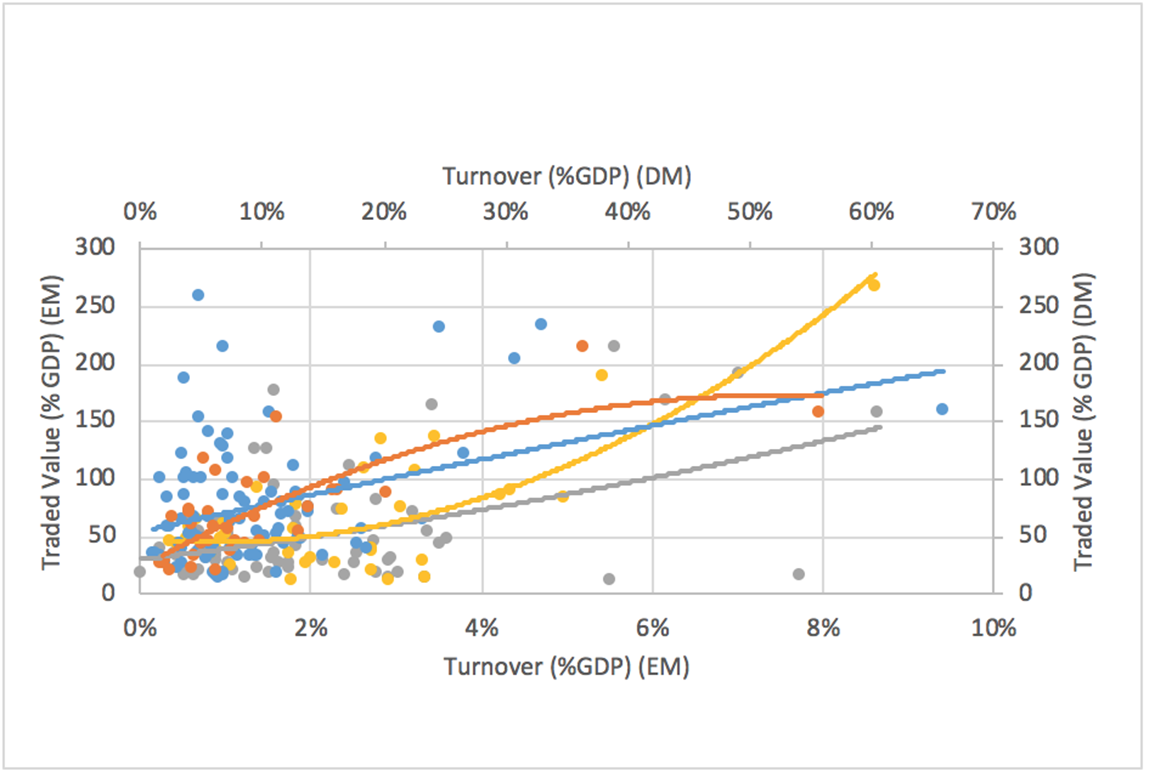

Source: own elaboration based on BIS and World Bank databaseThe alternative financing sub-channel is analyzed using three variables associated with the capital markets: stock market capitalization, traded value as % of GDP, and stock market turnover[8]. The first two variables capture variations in firm value, while the third one is used to analyze if derivatives have an impact on stock market liquidity. Previously, we discussed that correlations are expected to be positive for the first two variables, while there should be no correlation as to the third variable. The proper use of derivatives is expected to improve a firm’s valuation independently of variations in stock market liquidity.

Figures 4 and 5 show that correlation coefficients for the first two variables (market capitalization and trade volume as % of GDP) are quite similar. Correlation is positive in both cases for all the groups analyzed. The results are more substantial for developed markets, because of the lower expected volatility of their stock markets (prices are more closely associated with a firm’s fundamentals than to the political or macroeconomic risks, like in emerging markets). The pattern and significance of these correlations are similar to the ones seen for domestic credit, which drives us to similar conclusions. An expansion of the derivatives market is positively associated with the alternative financing channel, as long as the turnover is not high enough already.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

Source: own elaboration based on BIS and World Bank database

Notes: Singapore, Hong Kong and UK excluded due to extreme values

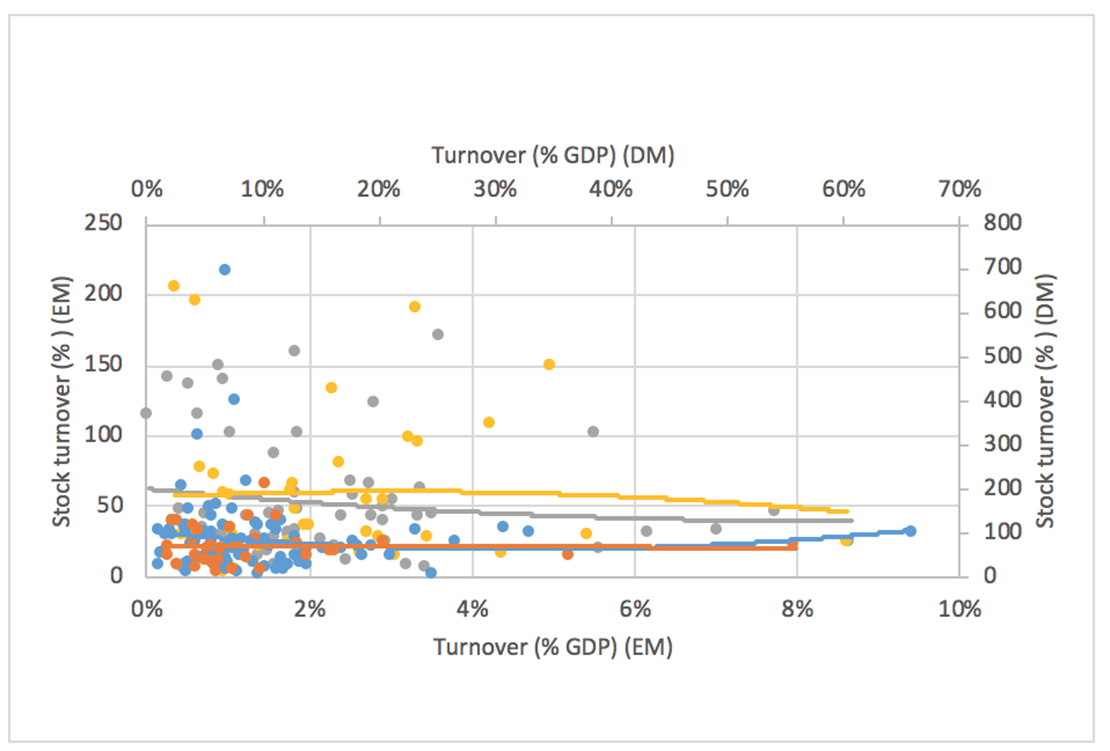

Source: own elaboration based on BIS and World Bank databaseFinally, Figure 6 shows that the third variable, stock market turnover, is not correlated with derivatives turnover in any of the sub-samples. This finding provides initial evidence that derivatives turnover is not associated with stock market liquidity. This is important because it implies that higher stock prices (i.e., higher market capitalization) might not be associated with increased liquidity (which would be exogenous to the firm) but with the fundamentals of the firms.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

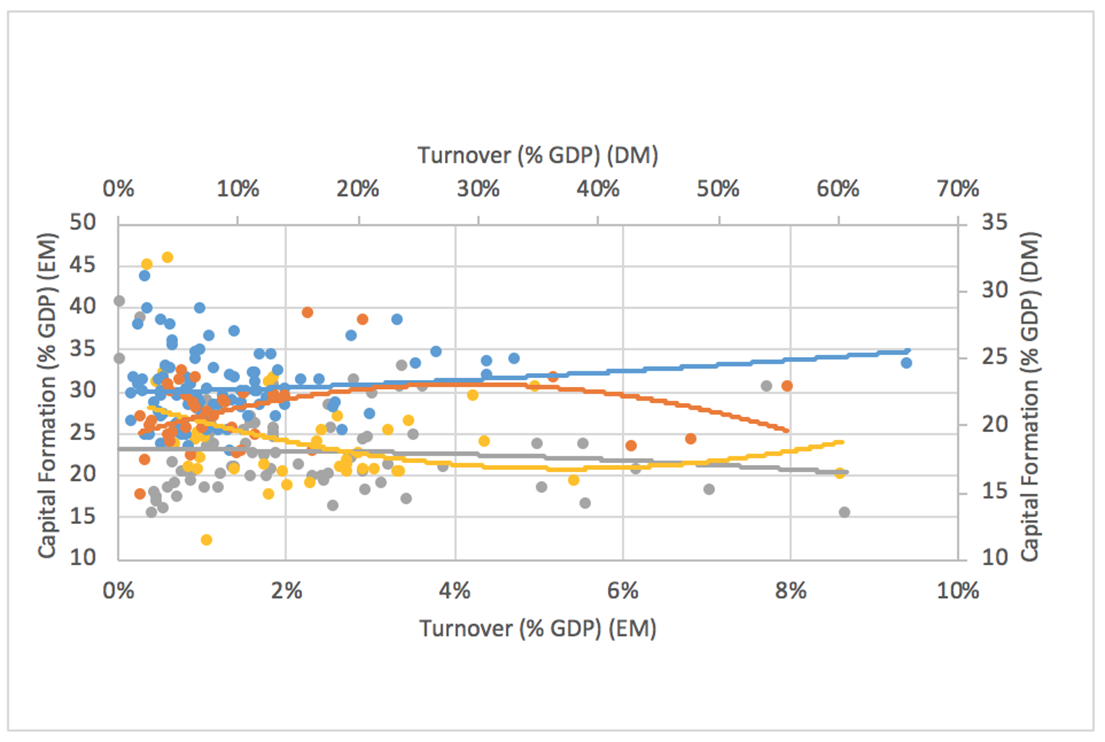

Source: own elaboration based on BIS and World Bank databaseThe final sub-channel associated with investment is incentives. In this case, we use the gross capital formation[9] due to the lack of a proper proxy variable to measure such incentives. This variable is expected to be positively correlated to derivatives turnover, as discussed previously.

Contrary to our assumption, correlation is not significant, except for the developed markets pre-2008 group (Figure 7). A possible explanation for the results observed in the developed markets would be the economic contraction experienced after the financial crisis and its impact on the investment decisions of the firms. A proper study of the incentives channel requires a firm-level analysis. The empirical evidence analyzed here is not enough to draw definite conclusions about this sub-channel.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

Source: own elaboration based on BIS and World Bank databaseTechnical progress channel

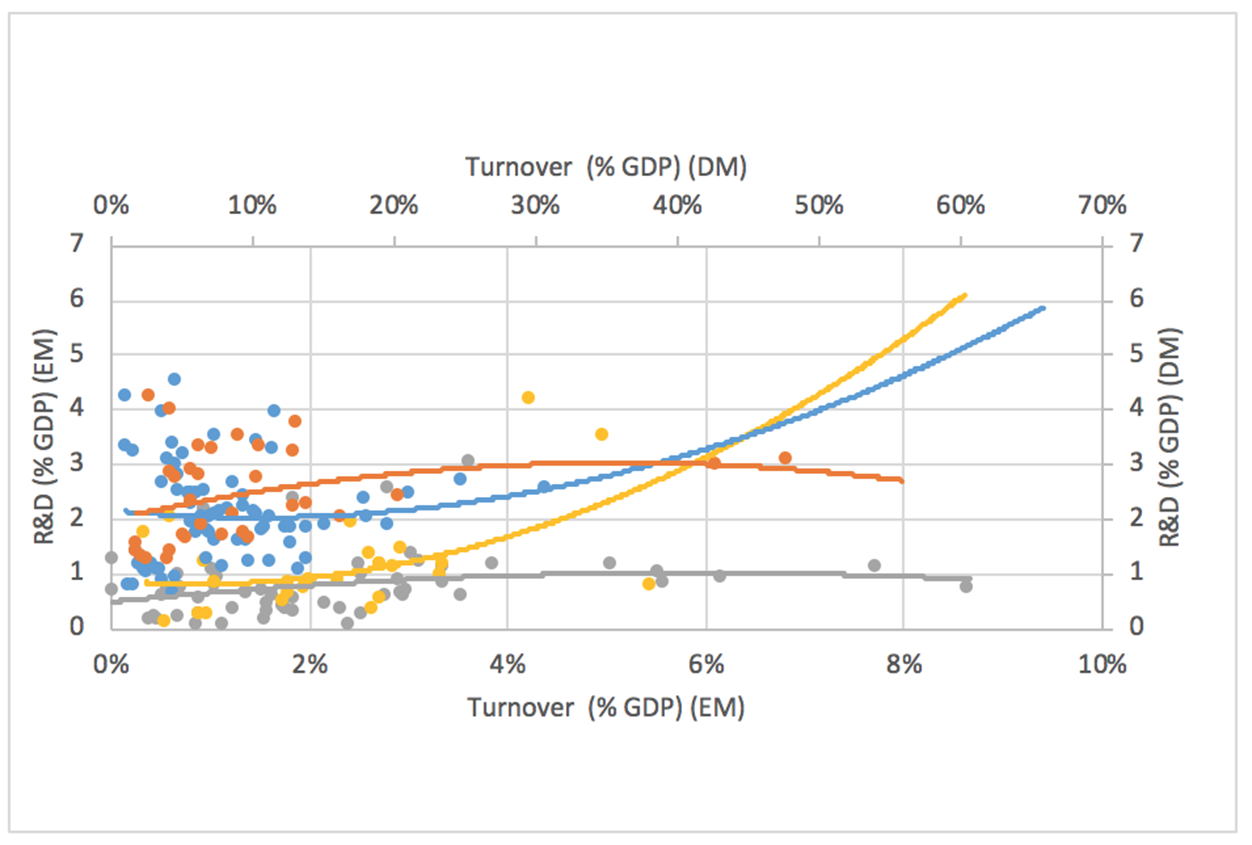

As we argued, the technical progress channel can produce ambiguous effects since the use of derivatives reallocate both financial and human resources (Cecchetti & Kharroubi, 2012) besides increasing the total productivity of factors. We use the expenditure in R&D as a % of GDP as a proxy for technical progress[10]. This variable does not allow us, however, to differentiate between both effects (Figure 8).

Looking at the correlation values for each group, we can see that they are not statistically significant. Despite this, if we look at the aggregated sample, the correlation turns out to be significant and positive. However, evidence on this channel is not conclusive. It leaves questions for future research on how one can disentangle the opposite effects that the development of derivative markets may have on both resource reallocation and the interaction between technical progress and physical investment.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

Source: own elaboration based on BIS and World Bank databaseInternational trade channel

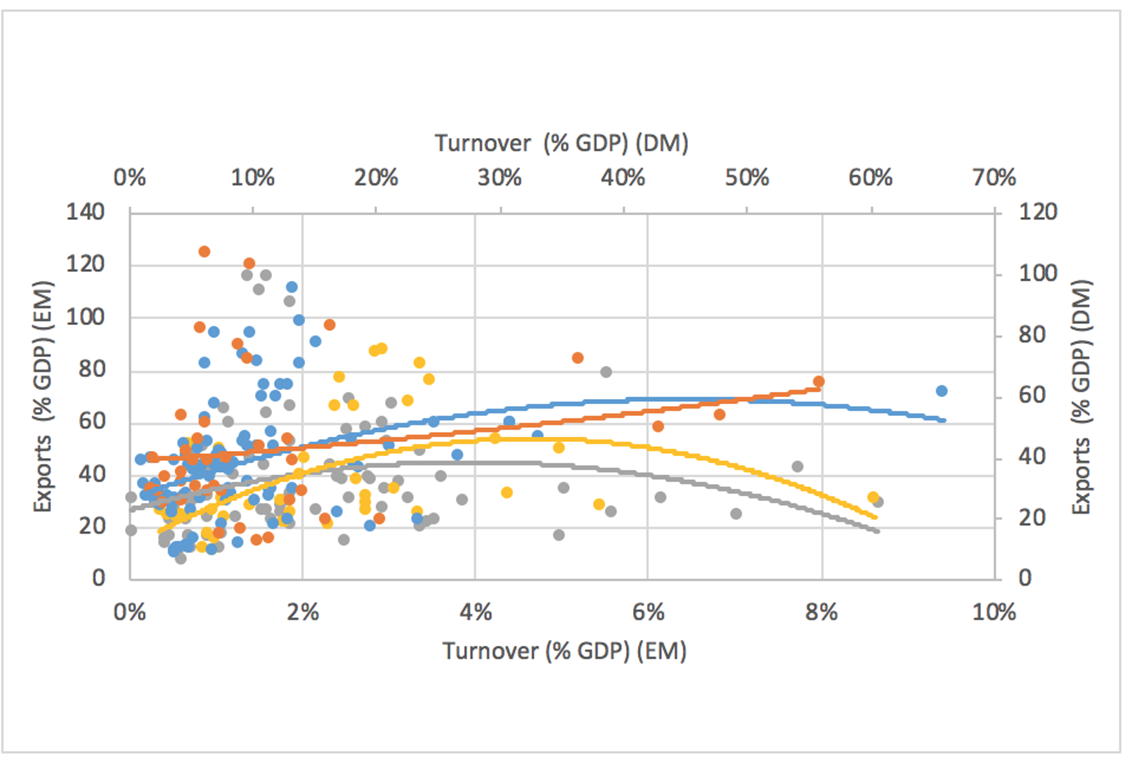

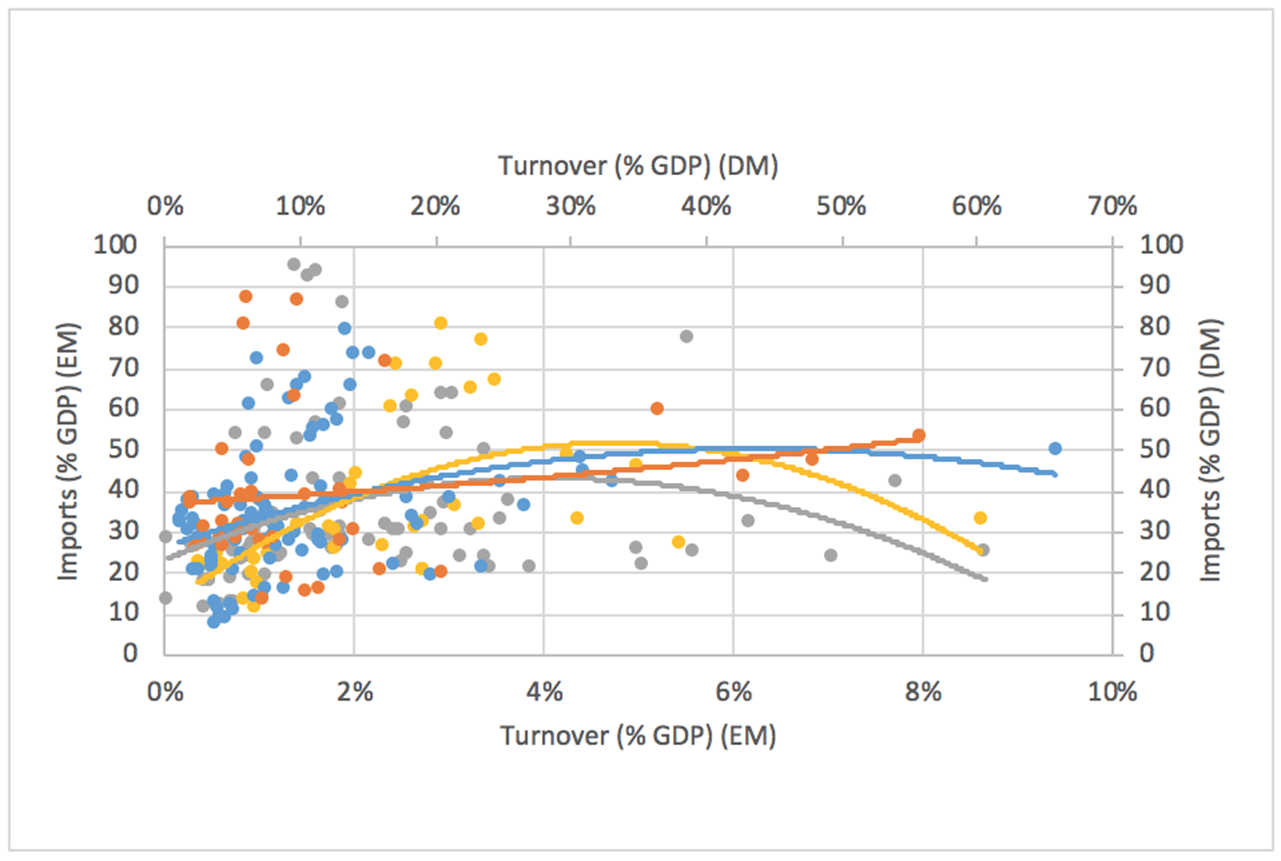

The International trade channel, measured by total trade to GDP[11], is one of the most relevant to account for how derivative markets can be associated with long-term economic performance. Given the volatility in currencies and international prices, derivatives foster an expansion of international trade in all directions (imports and exports). We expect positive and significant correlations in each of the sub-samples for these two variables.

Overall correlation coefficients are positive and statistically significant, in line with our analysis. The correlation between international trade and derivatives is higher in developed markets but decreases after 2008, unlike in emerging markets. It is also important to notice the U-inverted shape (Figures 9 and 10) of the correlation between both trade variables and derivatives turnover in 3 out of 4 sub-samples. The benefit of using derivatives to hedge against currency and interest rate fluctuations may decrease after a certain threshold.

Notes: Singapore, Hong Kong and UK excluded due to extreme values

Source: own elaboration based on BIS and World Bank database

Notes: Singapore, Hong Kong and UK excluded due to extreme values

Source: own elaboration based on BIS and World Bank databaseConclusions and economic policy suggestions

In this paper, we have analyzed the links between financial derivatives and a set of variables associated with economic growth. Three transmission channels were postulated through which derivatives impact economic growth: 1) investment, 2) technical progress, and 3) international trade. After studying each one of these channels and sub-channels separately, we have contributed to the economic literature and introduced derivatives into the economic growth analysis from a dual perspective: macroeconomic and financial. We draw three main conclusions:

As mentioned in the first section, several papers approach the nexus between financial development and economic growth. These authors can be split into two categories: 1) those who observe a positive correlation between financial sector development and economic growth, and 2) those who find a decreasing or null relation. Considering that derivatives can be treated as part of the financial sector, the results obtained in this paper are in line with both approaches. The positive correlation found mostly in emerging markets seems to confirm the results obtained by authors such as Levine and Zervos (1998), Levine (2004), or Michalopoulos et al. (2009). These authors, among others, find a positive correlation between the financial markets' depth and economic growth. They sustain that it is required to stimulate the financial sector to achieve higher levels of economic growth. The channels analyzed in this paper lead us to similar conclusions for the emerging countries, although using a Spearman correlation and not a regression analysis.

On the other hand, when looking at the results for developing countries, in general, these do not seem to support the same conclusions. As seen with the investment channel, it is possible to observe the existence of a decreasing relation, inverted U shaped, like the one found by Cecchetti and Kharroubi (2012). It is interesting to mention that these authors singled out the threshold in this relation to be close to 95% (measured as the participation of the financial sector in GDP), which does not disprove our analysis[12]. A more in-depth study of this relation would be required to confirm or refute this value as a threshold.

Future research could analyze the decreasing relation (inverted U) between derivatives and growth-trade related variables. Which are the negative effects that appear when derivatives turnover exceeds a certain threshold? Or, are the benefits the ones that start to disappear? Isolating the causes of this effect could allow an expansion of the frontier up to which derivatives boost economic growth. Finally, a firm-level analysis for emerging markets is desirable due to the different contexts in which these firms operate.

Bibliography

Andersen, T. B., & Tarp, F. (2003). Financial Liberalization, Financial Development and Economic Growth in LDCs. Journal of International Development, No 15, 189-209.

Bank for International Settlements. (19 de Septiembre de 2016). BIS Statistics Explorer. Obtenido de Bank for International Settlements: http://stats.bis.org/statx/toc/DER.html

Bodnar, G., & Gebhardt, G. (1998). Derivatives usage in risk management by U.S. and German non-financial firms: A comparative survey. NBER Working Paper No. 6705.

Cecchetti, S., & Kharroubi, E. (2012). Reassessing the impact of finance on growth. BIS Working Papers, No. 381.

Cecchetti, S., & Kharroubi, E. (2015). Why does financial sector growth crowd out real economic growth? BIS Working Papers, No. 490.

Fender, I. (2000). Corporate Hedging: The Impact of Financial Derivatives on the Broad Credit Channel of Monetary Policy. BIS Working Paper, No. 94.

Hakan, Y. (2011). Thresholds in the Finance-Growth Nexus: A Cross-Country Analysis. The World Bank Economic Review, Vol. 25 (2), 278–295.

Levine, R. (2004). Finance and Growth: Theory and Evidence. NBER Working Paper No. 10766.

Levine, R. & Zervos, S. (1996). Stock Market Development and Long-Run Growth. The World Bank Economic Review, Vol. 10 (2), 323–339.

Levine, R., & Zervos, S. (1998). Stock Markets, Banks, and Economic Growth. The American Economic Review, Vol. 88, No. 3.

Love, I., & Zicchino, L. (2006). Financial development and dynamic investment behavior: Evidence from panel VAR. The Quarterly Review of Economics and Finance, Vol. 46, 190-210.

Michalopoulos, S., Laeven, L., & Levine, R. (2009). Financial Innovation and Endogenous Growth. NBER Working Paper No. 15356.

MSCI. (11 de Junio de 2016). Market Classification. Obtenido de MSCI: https://www.msci.com/market-classification

Prabha, A., Savard, K., & Wickramarachi, H. (2014). Deriving the Economic Impact of Derivatives, Growth through Risk Management. Los Angeles. Estados Unidos: Milken Institute.

Rousseau, P., & Wachtel, P. (2009). What is happening to the impact of financial deepening on economic growth? Vanderbilt University, Working Paper No. 09-W15.

Si, W. (2014). Foreign Exchange Derivatives and International Trade in China. Financial Markets & Corporate Governance Conference, 2015.

The World Bank. (24 de Junio de 2016). Global Financial Development. Retrieved from the World Bank: http://data.worldbank.org/data-catalog/global-financial-development

The World Bank. (10 de Agosto de 2016). World Development Indicators. Obtenido de World Bank: http://data.worldbank.org/data-catalog/world-development-indicators

Tissot, B. (2015). Derivatives statistics: the BIS contribution. 60th ISI World Statistics Congress, (págs. 139-144). Rio de Janeiro, Brazil.

Yorulmazer, T. (2012). Has Financial innovation Made the World Riskier? CDS, Regulatory Arbitrage and Systemic Risk. Federal Reserve Bank of New York.

Annex: Descriptive Statistics and Correlation Coefficients

Notas

Información adicional

JEL: E44, G15, G29, G32, N20, O40