Artículo científico

Financial Development, Foreign Direct Investment, Exchange Rate Regimes, and Economic Growth: New Evidence from African Economies

Desarrollo financiero, inversión extranjera directa, regímenes cambiarios y crecimiento económico: nueva evidencia de las economías africanas.

Revista Económica La Plata

Universidad Nacional de La Plata, Argentina

ISSN: 1852-1649

Periodicity: Anual

vol. 69, no. 1, 2023

Received: 07 April 2022

Accepted: 30 March 2023

Abstract: This paper examines empirically the extent to which financial development, Foreign Direct Investment (FDI) and exchange rate regime (ERR) altogether positively influence economic growth in Africa. To achieve this, we build two baseline panel data samples of African countries and new expanded datasets spanning 1980-2015 using a small sample adjusted Generalized Method of Moments (GMM) estimator. To check the robustness of our results, we built two other panel samples by adding on the two previous panel data samples, data from emerging and developed countries, and repeating the analysis. The results from the estimations suggest that financial development, FDI influence positively and significantly economic growth, whereas exchange rate regime has no significant effect on economic performance, controlling for the usual growth- regression variables like trade openness, human capital, investment, governance, and the lagged value of per capita GDP.

Keywords: Financial Development, Foreign Direct Investment, Economic Growth, Africa, Exchange Rate Regimes.

Resumen: En este documento se examina empíricamente en qué medida en que el desarrollo financiero, la inversión extranjera directa (IED) y el régimen cambiario influyen en el crecimiento económico de África. Con este fin, se construyen dos muestras de datos de panel de países africanos y nuevos conjuntos de datos ampliados que abarcan 1980-2015 y se estima un modelo utilizando un estimador ajustado para muestras pequeñas del Método Generalizado de Momentos (GMM). Los resultados de las estimaciones sugieren que el desarrollo financiero y la IED influyen positiva y significativamente en el crecimiento económico en África, mientras que el régimen cambiario no tiene un efecto significativo en el crecimiento económico, controlando por las variables habituales como la apertura del comercio, el capital humano, la inversión, la gobernanza y el valor rezagado del PIB per cápita. Para verificar la robustez de nuestros resultados, construimos otras dos muestras de panel agregando datos de países emergentes y desarrollados y se repite el análisis encontrando resultados satisfactorios y similares.

Palabras clave: desarrollo financiero, inversión extranjera directa, crecimiento económico, África, regímenes cambiarios.

I. Introduction and Literature Review

I.1 Relevance and Background Literature

The adoption of the United Nations agenda 2030 for sustainable development by the international community in September 2015 created a new impetus among policy makers, practitioners, and academics for the interest in an old controversial debate on the separate and combined effects of exchange rate regimes, capital flows and financial development on long-term economic growth in developing and less developed countries. This renewed debate has its main foundation at the intersection of the Mundell impossible trinity theorem which states that no country can choose simultaneously its monetary policy, its exchange rate regime and its openness to capital flows on the one hand, and economic growth theories and convergence regressions where financial development, capital investment flows and exchange rate regimes are explanatory variables, on the other.

First of all, the debate on the influence of financial development and FDI on economic performance has been there for decades. At the early stages of this debate, the theoretical and empirical researchers contradicted one another on the role of the financial sector in the economy. The pioneers of development economics did not even consider finance as a determinant of growth (Meier et al., 1984). However, more recent theoretical models support the idea that financial development and FDI play a prominent role in economic and productivity growth by producing information, reducing costs associated with acquiring information, increasing, and improving the allocation of savings and investments, and diversifying and mitigating risks. The advocates of this theory explain that the provision of good information on firms and market niches (Morck et al., 2000; Howitt and Aghion, 1998) at a relatively lower cost to investors improves capital allocation in a context of market based-economy (Boyd & Prescott, 1986), the utilization of new technology (Greenwood and Jovanovic, 1990; Merton, 1987), and new processing methods and mechanisms (King and Levine, 1993b; Acemoglu et al., 2002). All these factors contribute to boost economic growth. In an efficient financial market, savings promote human capital development (Jacoby, 1994) and stimulate growth (Boyd and Smith, 1992; Lamoreaux, 1994) through increasing the availability of capital, reducing liquidity risk, effective exploitation of economies of scale and better allocation of financial services to all segments of population (Haber et al., 2003; Morck et al., 2005) and businesses. This will increase innovation in new production systems and positively affect the economic growth of a country.

Early studies like Goldsmith (1969) found a strong positive correlation between financial market development and economic activity. After controlling for other factors affecting long-term growth, King and Levine (1993a, henceforth, KL) find that financial development measured by banking credit or deposits is a good predictor of economic growth, physical capital accumulation, and total factor productivity. Cecchetti and Kharroubi (2012), however, show that the level of financial development is good only up to a point, after which it becomes a drag on growth, in developed economies where a fast-growing financial sector is detrimental to aggregate productivity growth. Rousseau and Wachtel (1998) and Levine et al. (2000) also report a positive correlation between both the stock market activity and banking system with growth. In the same vein, some researchers (Levine and Zervos, 1998; Beck and Levine, 2004) find a positive relationship between stock market development and economic growth.

Second, although capital flows are assumed to benefit industries (Rajan & Zingales, 1998) and recipient countries as they access cheaper financing (Levine, 2001; Klein and Olivei, 2008; Brezigar-Masten et al., 2011), a great deal of research on international financial integration and international capital inflows to developing countries does not confirm that beneficiary countries reap any benefit from it. The recipient countries need to meet certain conditions including quality of institutions (Ju and Wei, 2007), property rights, more developed banking sector (Chinn and Ito, 2005), stronger democracies, and other political and economic conditions. A body of existing literature suggests that large capital inflows in developing countries can create critical challenges including strong currency appreciation, asset price bubbles, rapid credit growth, financial sector fragility, just to mention a few (Prasad et al., 2005; Kose, et al., 2006, 2009). The recent 2008-2009 financial and economic crisis, the worst since WWII experienced by developed countries has created new impetus to the controversial debate on the real benefits of and capital inflows and financial integration in general. The crisis has intensified the vulnerabilities of the global international monetary and financial systems. Originating in developed economies, the crisis was channeled to emerging economies that relied heavily on foreign inflows and exposed them to financial fragilities. However, the international financial crisis did not impact Africa because of the low correlation between African financial asset markets’ returns and global market assets’ returns (Alagidede, 2008).

In principle, financial openness offers developing and less developed countries opportunities for attracting foreign investments and produces, ceteris paribus, a better allocation of resources and welfare increases (Obstfeld and Rogoff, 1994). This may not come without costs because higher financial opening can bring about structural changes exposing the economy to external shocks and financial volatility, with ambiguous outcomes on real variables. Foreign Direct Investment flows, unlike portfolio or derivatives flows, if directed to raise the productive capacity by expanding existing firms’ investments or augmenting greenfield investment, especially in tradable sectors, can bolster economic growth and total factor productivity. Examining the relation between FDI and economic growth from the mid-1980s onwards Li and Liu (2005) find that FDI fosters directly economic growth and indirectly through its interactions with human capital and technology transfer. Furthermore, analyzing the causality links between economic growth and FDI as well as economic growth and domestic capital in 13 MENA countries using GMM model over the period 1990-2010, Omri and Kahouli (2013) find a bi-directional causal relationship between FDI and economic growth; and domestical capital and growth and domestic capital and economic growth, and a unidirectional causal relationship from FDI to domestic capital in the region. Similarly, by using PMG/ARDL model in studying 22 countries Sub-Sahara African countries from 1988 to 2019, Ayenew (2022) conclude that FDI has a positive and significant impact on economic growth in the long run. They advise that Sub-Saharan African countries should attract more FDI to improve the economic performance and strive to minimize challenges that are hindering to FDI flows to the continent. Likewise, Jugurnath et al. (2016) reached the same conclusion that FDI contributes significantly to economic performance in Sub-Sahara countries and observe that FDI contribution to economic growth is more important than that of domestic investment. Conversely, Organisation for Economic Co-operation and Development (OECD, 2002) demonstrate the negative effects of FDI on the recipient countries. They indicated that FDI can worsen balance of payment because of the profits shifting, absence of a positive impact local enterprises, damage environmental impact, social disruptions, and it may harm competition in the national market. FDI through multinational companies may also discourage domestic investment due to their superiority in terms of technology, capital, and managerial skills over their domestic competitors. Third, the literature shows that there is no exchange rate regime that is suitable for all economies in all times (Frankel, 1999, Levy-Yeyati and Sturzenegger, 2005). As time passes, the structure of the economy also changes, and thus a country should adapt its exchange rate regime. The choice of regime, therefore, depends on the interest of the country and other economic aspects such as country openness to trade and external flows, the structure of production and exports, the nature of the financial system, the inflation history, the type of shocks, the credibility of the policies and institutions, and the level of the development (Grandes and Reisen, 2005).

Proponents of fixed exchange rate regimes believe that stable exchange rates reduce volatility, build credibility (Nnanna, 2002), create an environment of macroeconomic stability, stimulates international trade and finance (Frankel and Rose, 2002), and foster economic growth (Baldwin, 1989). Pro-flexible researchers, such as Meade (1951), argue that countries with flexible exchange rates are able to adjust to real domestic and external shocks more easily, and generates high productivity growth because the economy operates at its highest capacity (Aizenman,1994; Grandes and Reisen, 2005). Indeed, using a sample of 183 countries over the post Bretton Woods period, Levy-Yeyati and Sturzenegger (2003) find that, for developing countries, less flexible exchange rate regimes are associated with slower growth, as well as with greater output volatility. For industrial countries, the variation in exchange rate regimes does not appear to have any significant impact on growth. By contrast, Stotsky et al., (2012) find that exchange rate regimes do not drive economic growth whatsoever, while others advocate for intermediate regimes to boost growth (Sosvilla-Rivero and Ramos-Herrera, 2014).

Concerning Africa, Tsangarides and Qureshi (2008) suggest that fixed exchange rate regimes in the form of currency unions or direct pegs promote trade, which is in line with Masson and Pattillo’s (2005) findings. Simwaka (2010) recommends a peg arrangement as a viable option for the majority of low-income African countries. However, for middle-income African economies with relatively developed financial markets linked to global capital markets, floating arrangement looks more adequate. As the exchange rate is a function of market fundamentals such as money supply and demand, income and interest rates, any large change in money supply leads to a change in the level of exchange rate volatility (Bonser-Neal & Tanner, 1996), which could discourage international investors. Ojo (1990) advocates for an optimal exchange rate regime to maintain equilibrium in the inflow and outflow of foreign exchange in the economy.

I.2 Finance and Growth in Africa: literature review, hypothesis, and original contribution

Most African financial systems are underdeveloped, are subject to a high degree of informality, they depend mainly on banking and other informal credit sources (Alagidede and Ibrahim, 2018; Dankyi et al., 2022; World Bank, 2017 and 2021), receive less FDI inflows than peer Asian or Latin American developing countries, and have incipient stock markets, if at all.

As for the interrelations among our variables of interest, in African economies, with the likely exception of South Africa and some Maghreb countries, the financial system can be assumed not to shape the exchange rate regime choice. This happens because when financial development is low, the classical financial market variables (credit supply, interest rates) are disconnected from the exchange rate dynamics, exchange rate policies and ultimately monetary policy. Nor should FDI affect both the exchange rate policy choice and financial system development in these economies because FDI is usually not channeled through either the banking sector or the capital market (Levine, 2004; Otchere et al, 2016). Conversely, a shallow, underdeveloped financial system may dampen future FDI inflows (Kargbo, 2017; Otchere et al, 2016; Acquah and Ibrahim, 2019 ) due to the lack of appropriate financial instruments, infrastructure, and weak regulations, as well as the choice of a given exchange rate regime may foster credibility and financial stability and hence help financial systems develop. Moreover, the choice of exchange rate regimes can contribute, if supported by sound institutions and regulations, infrastructure development, higher formality, macroeconomic stability, and increased investment opportunities, to spur financial development and attract FDI (Levy-Yeyati and Sturzenegger, 2003; Grandes and Reisen, 2005). These complex theoretical interactions between financial systems, FDI and exchange rate regimes, and between the latter three and economic growth (Levine et al, 2000; Levine, 2004; Otchere et al., 2016) should be dealt with by adopting suitable econometric techniques that avoid endogenous variable biases and minimize potential collinearity effects.

To our knowledge, the literature on the finance-growth nexus in Africa is very recent and has not looked at the combined empirical effects of financial market development (FMD), FDI inflows and exchange rate regimes on long-run growth, nor at the single impact of the choice of these regimes. In addition, this literature has for the most not allowed for the stock market development as a proxy for financial development in the growth regressions and has not expanded the samples to check if the econometric results are robust when including other emerging or developed countries. In other words, is there a specific, heterogenous effect attributable to Africa?

For instance, in an early contribution to account for the role of FMD in economic growth, Yartey and Adjasi (2007) following Levine and Zervos (1998) estimate a panel regression using 14 African countries over the period 1990-2004 and find that, even if the stock markets have contributed to the financing of the growth of large corporations in certain African countries, there is an ambiguous effect of stock markets development on growth rates, depending on the proxy chosen. Despite Yartey and Adjasi (2007) is the only study1 to date which attempts to explain the role of African stock markets in economic growth, it ignores both, the effect of the banking sector as an alternative proxy for FMD and the importance of the choice of exchange rate policy, as well as the joint effect of FDI, FMD and exchange rate regimes on long-run growth rates.

Gui-Diby (2014) examines the impact of foreign direct investment (FDI) on economic growth in Africa and presents estimations based on panel data of 50 African countries during the period from 1980 to 2009. He finds that FDI inflows had a significant impact on economic growth in the African region during the period of interest. The study also finds that while the low level of human resources did not limit the impact of FDI, and that the impact of FDI on economic growth was negative during the period from 1980 to 1994 and positive during the period from 1995 to 2009. However, he does not control for exchange rate regimes and the combined effect of the latter, FDI and FMD, and does not use stock market development as a proxy for FMD.

Otchere et al (2016) find a bidirectional effect between FDI and financial market development (banking credit) and that FDI contributes to economic growth in Africa after controlling for endogeneity between FDI, financial market development (FMD) and economic growth. However, they do not include exchange rate regimes as a control variable, and they do not test for the significance of stock markets as a proxy for FMD. Kargbo (2017) studies the impact of FDI on economic growth and the interaction of the former variable with human capital and productivity gains over the period 1996-2011, however without jointly and separately estimating how of FMD, FDI an ERR affect economic growth as well as omitting stock market development.

Alagidede and Ibrahim (2018), using a sample of 29 sub-Saharan Africa countries over the period 1980–2014 and a threshold estimation technique, check that while financial development is positively and significantly associated with economic growth in a non-linear fashion, below a certain estimated threshold, finance is largely insensitive to growth while significantly influencing economic activity for countries above the thresholds. Like Otchere et al (2016), notwithstanding the non-linearity result, they omit FDI and exchange regimes as determinants of long-run growth, they only consider private and domestic banking credit and there are no robustness regressions including emerging and developed economies.

Acquah and Ibrahim (2019) examine the relationship among FDI, economic growth and FMD relying on annual panel data spanning 1980–2016 from 45 African countries and controlling for endogeneity among these variables. They find that the effect of FDI on economic growth although positive in general, is conditioned on the model specification, and that FMD dampens that positive effect. These authors ignore the joint effect of FMD, FDI and exchange rate regimes, do not use stock market development to measure FMD and employ different dependent variables compared to ours and other studies akin: total GDP growth rates and per capita GDP in levels, when the most appropriate should be GDP per capita growth rates (Barro and Sala-i-Martin, 2003).

Finally, Dankyi et al. (2022) drawing from panel data from 1990 to 2017 analyze the dynamic relation between economic growth, human capital, FDI, CO2 emissions and urbanization in Economic Commission for West African States (ECOWAS) and discover that the rate of human capacity, FDI, CO2 emissions and urbanization have a positive on economic growth in Low and Middle-Income Countries. The limitation of their paper is that is circumscribed to a specific region of Africa, let alone they do not test for the impact of FDI, or the joint effect of the latter, FMD and exchange rate regimes on economic growth.

In sum, the literature on the finance-growth links in Africa, even when controlling for potential endogeneity, generally ignores the joint effect of FMD, FDI and exchange rate regimes or the individual effect of the latter on long-run growth , it does exceptionally consider stock markets as a proxy for FMD, and does not expand the sample to emerging markets and more developed economies to check whether the econometric results hold and there is an African-specific effect (even a non-linear one) or not.

On the back of this literature and its mixed results, this paper we raise the question of how financial development, FDI and their interaction with different exchange regimes jointly affect per capita long-run economic growth rates in African economies controlling for the typical conditional convergence-regression variables over the period 1980-2015? We also ask whether the stock market development is a good proxy to account for financial development and therefore economic growth rates, however without ignoring the role of the banking sector. Finally, we inquire into whether variables altogether remain robust and affect long-term economic growth when we expand the sample to some emerging and developed countries during the same period.

Based on research on the relationship between financial development, FDI, exchange rates regimes and economic growth, the article formulates three main hypothesis that will be tested in next sections:

H1: In principle, financial development affects positively economic growth in Africa but there may be mixed or insignificant effects over the panel sample period.

H2: FDI increases economic growth over the sample period.

H3: The relationship between exchange rate regimes and economic growth is ambiguous and not necessarily significant, nor unidirectional, i.e., different regimes may produce similar outcomes in long-rung growth rates.

This paper makes a threefold contribution to the literature. First, controlling for potential endogeneity, it estimates the combined effect of financial development, FDI and exchange regimes on economic growth using a broad sample of African countries over 1980-2015, unlike the former literature which tested the standalone or combined effect FMD and FDI on long-run growth. Second, it is the first contribution to introduce two separate measures of FMD in the African panel growth regressions, namely domestic bank credit to GDP and stock market capitalization to GDP even when the latter variable shrinks our sample to 12 countries. Third we check the robustness of the econometric results by adding two samples of 21 emerging and developed countries. The rest of the paper is structured as follows: Section 2 presents our dataset and describes how the variables are measured, while section 3 explains the model and econometric methodology. Section 5 discusses the empirical results and Section 6 concludes and draws some policy lessons.

II. Data, sample, and measurement of variables

This study aims to investigate empirically the possible direct and indirect influence of exchange rate regimes, financial markets development and FDI on economic growth in Africa controlling for the usual variables included in the growth-conditional convergence literature.

The annual percentage growth rate of real per capita Gross Domestic Product (GDP) is used as a proxy to the dependent variable of study. The independent variables include financial development represented by two separate variables for the sake of robustness and the contrast of the paper´s hypothesis, namely (i) bank credit to private sector over GDP (DCP) and (ii) stock market capitalization over GDP, Foreign Direct Investment (FDI), the degree of trade openness of the economies corruption, human capital, inflation, and exchange rate regimes.

II.1 Sample

Based on the two alternative financial development variables (stock market capitalization over GDP and domestic credit to the private sector provided by banking system over GDP), we construct t two baseline panel data samples from African countries over the period 1980-2015 and then we compute 5-year averages of all variables in line with the growth regressions literature surveyed in Section 1.2 and Barro and Sala-i-Martin (2003) so that the business cycles effects are avoided.

The first panel consists of twelve African countries which have stock markets: Botswana, Cote d’Ivoire, Egypt, Ghana, Kenya, Malawi, Mauritius, Nigeria, South Africa, Tanzania, Tunisia, and Uganda. The second main panel is composed of forty-nine African countries which have banking systems: Algeria, Angola, Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Comoros, Congo, Cote d’Ivoire, Djibouti, DR Congo, Ethiopia, Egypt, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea, Guinea Bissau, Kenya, Liberia, Libya, Lesotho, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Mozambique, Namibia, Niger, Nigeria, Rwanda, Senegal, Seychelles, Sierra Leone, Sudan, South Africa, Swaziland, Tanzania, Togo, Tunisia, Uganda, Zambia, and Zimbabwe. Other African countries are not included in the samples because they do not have sufficient data on several explanatory variables.

To check the robustness of the two-foregoing panel results, we construct a third and a fourth sample by adding to the first and second main samples, twenty-one emerging and developed countries including: Argentina, Chile, China, Malaysia, Turkey, Pakistan, Philippines, Mexico, Brazil, Russia, South Korea, Japan, Finland, United Kingdom, France, Germany, USA, Belgium, Ireland, Switzerland, and Australia.

II.2 Data sources

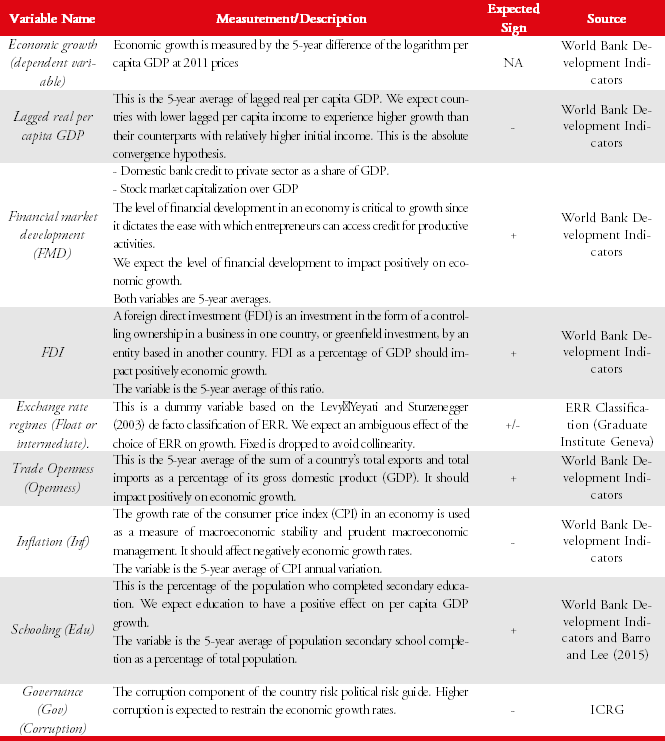

Data from the following organizations were used: African Securities Exchanges Associations, African Development Bank, United Nations Conference on Trade and Development, World Bank, and Graduate Institute Geneva. See Table 2 below for mor details.

II.3 Description of Variables

II.3.1 Economic growth

We measure the dependent variable, economic growth, by the annual percentage growth rate of per capita Gross Domestic Product (GDP PPP). In order to ensure comparability across countries with different currencies, we use GDP PPP which is the GDP converted to international dollars using purchasing power parity rates. Data are expressed in constant 2011 US dollars.

II.3.2 Determinants of economic growth

II.3.2.1 Financial markets development

A good measurement of FMD is crucial in assessing the progress of financial sector development and understanding the corresponding impact on long-run economic performance. In practice, however, it is difficult to measure financial development given the complexity and dimensions it encompasses. To measure a well-functioning financial system, the largest share of empirical research has so far two used two standard quantitative indicators such as: (i) the ratio of bank credit to private sector to GDP (King and Levine, 1993[4] a; Levine et al., 2000; Allen et al, 2011, Cecchetti and Kharroubi, 2012; Acquah and Ibrahim (2019)) to measure bank performances, and (ii) stock market capitalization to GDP (Levine and Zervos, 1998; Yartey and Adjasi, 2007; Allen et al., 2010; Kargbo, 2017) to measure the performance of capital market since the domestic debt market is still at nascent stage in most African countries. Private sector credit to GDP captures the size of the banking sector relative to the economic output, while the ratio of stock market capitalization to GDP measures the contribution of capital market to the economy. In principle, we expect a positive effect of FMD on economic growth. However, this could be ambiguous conditional on the development financing mix and other control variables.

II.3.2.2 Foreign Direct Investment

When a country has a greater access to international market finance and investment opportunities arise, it grows more rapidly, ceteris paribus, because it has access to technologies and the volume of trade and foreign investment increases (Obstfeld & Rogoff, 1994; Barro & Sala-i-Martin, 1997). Increased FDI either in augmented firm ownership control or greenfield investments raises long-run growth and productivity. We measure FDI as the ratio of foreign direct investment assets to GDP because we are interested in the impact of the variation in the FDI depth on growth as opposed to the net inflow share in GDP, in line with Li and Liu (2005), Gui-Diby (2014) and Dankyi et al. (2022).

The relative increase of FDI flows in the region during the last two decades or so has been caused mainly by the high demand for oil, minerals, other natural resources and the construction of infrastructure projects, banking, and telecommunication industries, which are heavily intensive in physical capital and technology (PwC, 2017). Therefore, we do not allow for threshold effects in variables like human capital or interaction terms of FDI with other variables (Kargbo, 2017; Acquah and Ibrahim, 2019), and a positive sign on the coefficient of FDI in the economic growth regression is expected.

II.3.2.3 Trade openness

It has been shown that in the long-run, trade openness can potentially enhance economic growth by providing access to goods and services, achieving efficiency in the allocation of resources and improving total factor productivity through technology diffusion and knowledge dissemination (Barro and Sala-i-Martin, 1997; Rivera-Batiz and Romer, 1991; Rose, 2002;), It is therefore expected that countries with more trade openness will outperform those with less openness. From this perspective, developing countries have much to gain by trading with advanced countries. Despite this expected positive effect, trade openness may impact economic growth negatively for countries which specialize in production of low-quality products (Haussmann, Hwang, and Rodrik, 2007). For instance, countries exporting primary products are vulnerable to terms of trade shocks. Despite these conflicting views, the general belief is that openness to international trade is beneficial (or at least not detrimental) to economic growth, especially for developing countries. The empirical literature on African countries shows that trade openness has a positive impact on trade and investment and significantly influences economic growth.

We measure trade openness using the ratio of total exports plus imports over GDP in line with this literature (Yartey and Adjasi, 2007; Chang and Mendy, 2012; David et al., 2014, among others). Even though there are alternative measures for trade openness like tariffs or per capita exports plus imports, our measure has longer data availability and consistency.

II.3.2.4 Exchange rate regime (ERR)

The impact of EER on economic performance is not straightforward. As stated in Section 1.1 In the literature, both positive and negative impacts have been found. We use the de facto classification of exchange rate regimes developed by Levy-Yeyati and Sturzenegger (2005) based on cluster analysis techniques that group countries according to the behaviour of three variables: (i) exchange rate volatility ( Importar imagen ), the standard deviation of a moving window average of the absolute monthly percentage changes in the nominal exchange rate over the year; (ii) volatility of exchange rate changes Importar imagen , measured as the standard deviation of the monthly percentage changes in the exchange rate; and (iii) volatility of reserves measured ( Importar imagen ) measured as the standard deviation of the average of the absolute monthly change in dollar denominated international reserves relative to the dollar value of the monetary base. These variables are computed on an annual basis so that each country has yearly observations over our sample period unlike other possible competing variables Following the criteria and clusters in Levy-Yeyati and Sturzenegger (2005) the exchange rate regimes are summarized in the table below:

Our ERR variable is a dummy variable where, for instance the variable “Flexible” takes on a value equal to one if the ERR is flexible and zero otherwise.

II.3.2.5 Inflation

Inflation is a good proxy for macroeconomic stability and domestic balance. Higher inflation brings about heightened uncertainty, negatively impacts currencies fluctuation, commodity prices; and erodes external and fiscal positions as well as confidence of international investors in the domestic economy and assets. Regarding the relationship between inflation and economic growth, standard literature suggests that these two variables are negatively associated (Bruno, 1995; Gokal, 2004). We measure inflation by the annual percentage variation in the consumer price index (CPI) as it is customary in the theoretical and empirical conditional convergence growth regression-literature (King and Levine 1993a; Barro and Sala-i-Martin, 2003; Levine, 2004 or Alagidede and Ibrahim, 2018 and Acquah and Ibrahim, 2019 for the case of Africa).

II.3.2.6 Human capital development

The theoretical and empirical evidence suggests that human capital development exerts a positive effect on economic growth (Solow, 1956; Lucas, 1988; Barro and Sala-i-Martin, 1997, Barro and Lee, 2015 or Gui-Diby, 2014; Kargbo, 2017 and Alagidede and Ibrahim, 2018 regarding African country-specific evidence). Human capital development also has a positive impact on financial development and therefore on economic performance. Indeed, economic growth involves human capital development and an increase in literacy ratio. Population education is typically used as a proxy of the quantity and quality of human capital development in a country.

Although the literature employs different proxies for human capital accumulation such as average years of schooling, the percentage of the population enrolled in secondary school or the percentage of the active population following tertiary education, among others, (Barro and Lee, 2015), we measure human capital development by the percentage of the population having completed the secondary school. In countries like in Africa, we believe there should be a stronger impact of the latter variable on economic growth because of the increasing returns to education once the secondary level is finished. Notwithstanding our choice, the selection of a proxy variable for human capital development remains controversial to date.

II.3.2.7 Governance

Although governance is a broad and controversial concept, good governance, peace and security and a stable society are, in general, prerequisites and determinants of economic growth and development without which any socioeconomic progress is possible. The adverse effect of poor economic and political governance continues to hamper the development of the region. While researchers, such as Cull and Effron (2008), find that bad governance foster financial development in developing countries, others such as Fraj and Lachhab (2015) among others, find that corruption has a negative influence on capital accumulation and restrains economic growth of developing countries. Therefore, we include good governance in the regression and use “level of corruption” as one of the indicators of measurement developed by Kaufmann et al. (2011) to proxy good governance. More specifically, we the indicator developed by International Country Risk Guide, which is one of the best commercial sources of country risk analysis and rating and has one of the longest time series available worldwide for developing countries. A higher ranking means a less corrupted country so the expected sign of corruption on economic growth is positive in this case.

Table 2 summarizes the regression variables, their measurement, the expected sign of the explanatory variables on the dependent variable, i.e., real per capita economic growth rates, and the sources of data.

Source: own elaboration.

III. Model and Methodology

III.1 Model

We built a panel dynamic model using the generalized method of moments (GMM), a 2-step estimator which allows for corrections for small samples and endogeneity biases that we will explain below.

Our panel model can be written as follows:

[1]

[1]where:

is the dependent variable.

matrix of independent variables

and the error or the random term of the model.

is a vector of fixed effects.

For an observation of the panel data it, the model is:

[2]

[2]A panel model is dynamic when the lagged value of the dependent variable is introduced as an explanatory variable. Thus, the model is written as follows:

[3]

[3]where:

: annual percentage of per capita GDP growth rates of country in year

: lagged annual percentage of growth rate of GDP per capita of country in year

The are control variables and include:

: financial market development (credit to private sector or stock market capitalization over GDP) of country in year .

: foreign direct investment over GDP of country in year .

: a dummy variable equal to one when the country´s ERR is a de facto floating regime and zero otherwise.

: a dummy variable equal to one when the country´s ERR is a de facto intermediate regime and zero otherwise. We drop the variable “Fixed” to avoid collinearity with the latter two variables.

: inflation rate of country in year .

: trade openness of country in year .

: percentage of people who attained secondary education in country in year .

: Level of corruption of country in year

is the country fixed effect.

is the time fixed effect.

: is the model error term.

III.2 Panel model diagnostic tests

Before proceeding to the GMM econometric estimation, we perform a panel data unit root or stationary test to check whether the series are stationary or not and confirm they are I(0). Then, in order to check if our data can be specified in panel data, we carry out the probability test where the alternative hypothesis favours a panel structure in our data. We also apply specification tests to check whether the theoretical model is perfectly identical for all the countries or whether there are specificities to each country, concluding there are significant country-specific effects.

Next, we perform the Hausman test to choose between fixed-effect model and random-effects model which allows to consider the heterogeneity of the data2. Finally, we apply the Sargan test to select instrumental variables (the error term should not be correlated with the exogenous variables if the instruments are valid). If the Ho is not rejected, the instruments are valid. The use of instrumental variables is based on the principle summarized in the Table 3 below.

III.3 Estimator Generalised Method of Moments

We apply the GMM estimator introduced by L. Hansen in 1982 to avoid difficulties in using the estimator Ordinary Least Squares (OLS), which is biased due to the inclusion of the lagged dependent variable and it is also not consistent Under the assumption of random effects, the Generalized Least Squares estimator (GLS) is also biased, that is why Arellano and Bond (1991) suggest the use of first differences of the dependent variable or lags of two periods to formulate instrumental variables. Other reasons behind the use of a GMM dynamic model are to address endogenous issues related to reverse causality or simultaneity bias and omitted variables or error in measuring the dependent variable; and to monitor both individual and temporal specific effects.

In addition, it should be noted that the application of the GMM on panel data has another advantage: it generates the instruments from the explanatory variables; This is not the case for other traditional methods of instrumental variables such as 2SLS and 3SLS, which require that the theoretical instrumental variables chosen are correlated with the explanatory variables and not correlated with the residual, which is somehow difficult to find. Because of the small-sample correction, we use the two-step GMM. Two-step estimators use first step estimates to estimate the parameters of interest in a second step. The two-step estimator problem arises because the second step ignores the estimation error in the first step.

Finally, we perform the Arellano-Bond test to check the validity of the GMM method in a system. It tests for the absence of second order autocorrelation (AR(2)) in residuals and first order negative serial correlation (AR(1)).

The results of the different statistical tests show that the 2-step GMM models are appropriate and valid.

IV. Empirical Results

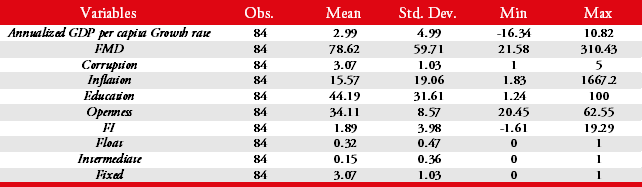

IV.1 Descriptive statistics

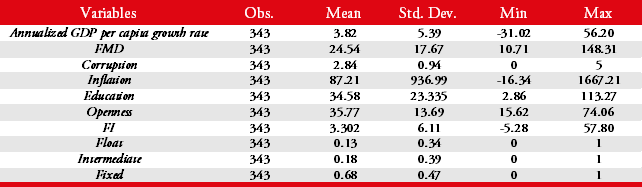

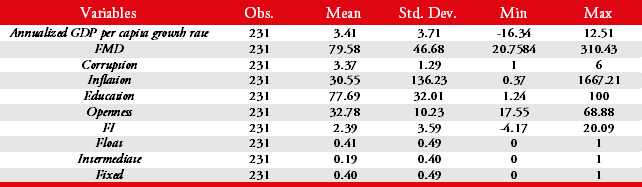

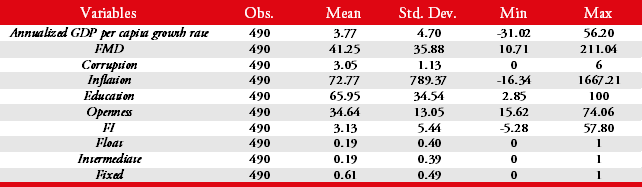

Tables 4-a and 4-b and Tables 5-a and 5-b display the descriptive statistics for our two samples including only African countries and the two expanded samples including emerging and developed countries we use for the sake of robustness, respectively. We notice a high dispersion in all variables because of the nature and composition of our samples.

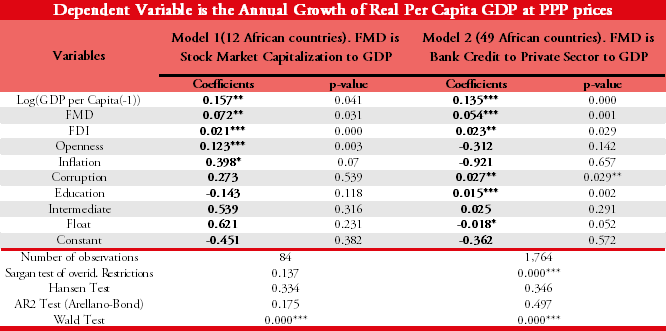

IV.2 Results of baseline models

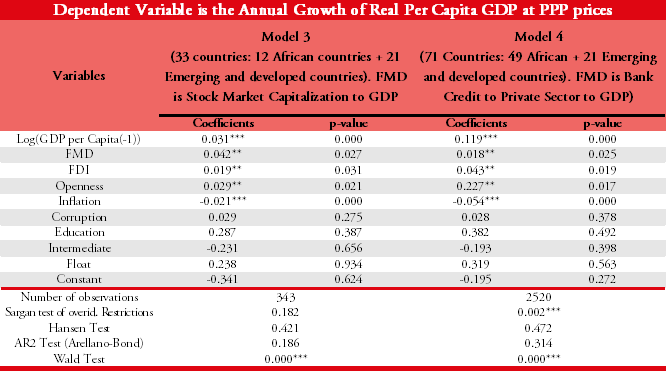

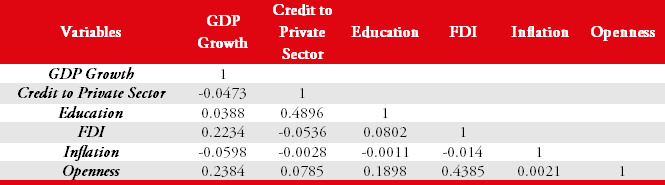

Tables 4-a and 4-b show the results of the two main models, 1 and 2. Results in Model 1 should be read with caution due to the small sample of African countries with stock markets. In both models, two out of our three variables of interest, financial development and FDI, turn out positive and impact significantly economic growth at a significance level of 5 percent. Financial development proxied by market capitalization over GDP and bank credit to private sector to GDP; and FDI over GDP have strong effect on the wealth creation in a country. An increase of 10 points of stock market capitalization over GDP (model 1) and 10 points of credit to the private sector over GDP (model 2) increased GDP per capita growth by 0.7% and 0.5% respectively. An increase of 10 points in the FDI to GDP ratio increases economic growth by 0.21 (model 1) and 0.23% (model 2). The exchange rate regime, another variable of our interest, has no statistically significant effect on growth except for floating regimes in model 2 where they come out negatively associated with economic growth at the 5% level of significance. The results of the estimation are presented in Table 6 below. Note that linear correlation among the explanatory variables is very low (less than 0.25) or null, except for FMD and Education. This indicates that our model estimators would not be affected by multicollinearity (see Table A in the Annex).

IV.3 Robustness checks and results discussion

To check the robustness of our results, we added 21 emerging and developed economics to the two baseline samples. The results of these two models (Table 7 below) are also positive and show that financial development and FDI impact significantly economic growth. Exchange rate regime has no significant effect on growth. Our results are therefore robust to the inclusion of developed and emerging countries.

Again, the results obtained in the expanded models show that financial development and FDI foster the productive capacities and support higher economic growth. Financial development proxied by stock market capitalization over GDP and bank credit to private sector to GDP; and FDI over GDP significantly influence economic performance. Here, an increase of 10 points in stock market capitalization over GDP (model 3) and 10 points in of credit to the private sector over GDP (model 4) increase GDP per capita growth by 0.4% and 0.18% respectively. These results are very close to those in the earlier general literature (King and Levine, 1993a; Levine and Zervos, 1998, Levine 2004, Cecchetti and Kharroubi, 2012 though we do not test a non-linearity in FMD) and consistent with the specific literature on Africa including Yartey and Adjasi (2007), Otchere (2016); Kargbo (2017); Alagidede and Ibrahim (2018) but contrary to Acquah and Ibrahim (2019) who find a negative impact of both banking credit to private sector over GDP and the latter interacted with FDI on GDP growth respectively.

Also, an increase of 10 points in the FDI to GDP ratio increases economic growth by 0.2% (model 3) and 0.1% (model 4), respectively. Overall, these findings are in line with Li and Liu (2005); with Gui-Diby (2014), Otchere et al (2016), Kargbo (2017); Acquah and Ibrahim (2019) and Dankyi et al (2022) who find a strong and positive impact of FDI on long-run growth over different sample periods and controlling for non-linearities or threshold variables (Kargbo, 2017); interactions between FDI and FMD (Acquah and Ibrahim, 2019), or between FDI and human capital (Gui-Diby, 2014).

As for the exchange rate regimes, and contrary to the theoretical expectation (Aizenman, 1994; Schmidt-Hebbel et al. 1996; Levy-Yeyati and Sturzenegger, 2003; Rose, 2002; and Grandes and Reisen, 2005), we notice that there is no general significant influence of the exchange rate regime on economic performance in the four regression models. The only exception is model 2 (49 African countries) where floating regimes enter negatively and significantly at the 5% level in the growth regression indicating that countries which float their currencies grow up to 5% less than the sample average in the long run. This is not surprising as most African countries have been pegging their currencies or have joined monetary unions since the nineties (Ecowas, the Rand zone, to name a few) or earlier shortly after independence.3 Furthermore, Rogoff, et al. (2003) have found that countries with under-developed and un-integrated financial markets like in Africa, fixed or relatively rigid intermediary regimes are associated with low-inflation and higher economic performance while in developed countries with well-functioning financial system and strong institutions, the flexible rate regime are the best. Nnanna (2002), Frankel and Rose (2002) and Masson and Pattillo (2005) found that fixed regimes stimulate economic growth because of the elimination of currency volatility, trade risks and access to technological and increased foreign investment.

Another possible explanation behind the general inconsistency of our results with those in previous studies may be attributable to the measurement of exchange rate regime, the econometric model and dataset range used and period of investigation, which may not be appropriate to determine the direct relationship between the two variables and else, the combined effect of FMD, FDI and ERR on economic growth.

Regarding the control variables, the positive sign of the lagged value of per capita GDP, contrary to our expectations, might be due to some collinearity between the latter and other explanatory variables, in particular the lagged value of the per capita GDP growth rate which the dynamic GMM estimator allows in the equation.

Trade openness has a positive influence on the economic performance in all models except model 2. For instance, in Model 1 and Model 4 (sample expanded to emerging and developed countries) when exports plus imports over GDP grow by 1 percentage point, per capita GDP growth rates rise by 1.2% or 2.27%, respectively These findings are consistent with Chang and Mendy (2012) who find that openness in trade and investment is positively and statistically significantly related to economic growth. Other researchers such as David et al (2014) have found that trade openness may have a positive impact on financial development in Sub Saharan African countries with better institutional capacity, hence on long-run growth. Also, according to Huchet-Bourdon et al. (2013), exporters of higher quality products grow faster. The theoretical argument behind a positive link between openness and growth is that trade openness enables transfer of innovation, technology, and knowledge, especially in more developed economies (Grossman and Helpman, 1991), and the reallocation of resources to increase the level of production.

Corruption has no significant influence on economic growth except for model 2 where it has a strong significant negative influence on economic growth, i.e., a higher value of the proxy for corruption implies a less corrupted country and thereby higher growth, ceteris paribus. The fact that corruption is not significant in other models may be attributable to its measurement and the data range. Nevertheless, the findings of model 2 are in line with some literature on the theory of the negative relationship between corruption and economic performance (Fraj and Lachhab, 2015) and the findings reported by Rose, Ackerman and Klitgaard (1988) that highlight the negative consequences of corruption on economic development. In general, good governance attracts productive investments, fair public spending in education and health care and stable society which are prerequisites and determinants for economic growth and development without which any socioeconomic progress is possible.

Inflation has a positive but non-significant effect at the 5% level on growth in model 1 and no significant effect on growth in model 2, whereas in models 3 and 4, it has a negative and significant effect at the 1% level. Like other studies, we find that inflation is negatively associated with economic performance (Gokal, 2004) in the models with developing, emerging, and developed countries. This confirms the theory on the inverse relationship between inflation and economic growth. Maintaining a stable macroeconomic environment in terms of low inflation is a prerequisite for sustained economic performance in the long run.

Finally, the results show that human capital development has no significant impact on economic growth in all the models except model 2. This does not mean that an improved educational system of a country along with a higher percentage of the population completing secondary school does not enhance the productive capacity of that country. According to the literature, education has not only a positive effect on financial inclusion but also on financial management and hence on economic growth (Cole, et al. 2014). Education is critical for people and gives them skills and tools to work better and create opportunities for economic growth now and in the future.

V. Conclusion

The main purpose of this paper was to investigate empirically the relationship between financial development, FDI, exchange rate regime and economic performance in Africa. We built panel databases using expanded datasets over the period 1980-2015 (5-years average) and sample data from African, emerging, and developed countries. To achieve our objective, we employed the 2-step GMM dynamic estimation panel model on two main samples: one composed of twelve African countries using stock market capitalization over GDP as indicator of financial development and the other one composed of forty-nine African countries using credit to private sector over GDP as financial development indicator. To check the robustness of our results, we built two additional panel samples by adding on the previous two panel data, data from emerging and developed countries and ran the analysis. The results of the different statistical tests show that all fitted models are theoretically reliable.

Our results of baseline models and robustness models suggest that both financial development and financial integration have a significant positive relationship with economic growth in Africa. In short, efficient, and greater integrated financial systems in the region is positively associated with higher economic activity confirming the growing body of empirical analyses that demonstrate the strong positive connection between the function of financial system and long-term economic performance. However, both models contradict the theoretical expectation of the possible influence of the exchange rate regime and economic performance and other aspects of macroeconomic policy (Aizenman, 1994; Schmidt-Hebbel et al., 1996). The fact that our results do not confirm the significant impact of exchange rate regime of economic performance, it does not mean that the choice of regime has nothing to do with other economic aspects such as country openness to trade and external flows, structure of production and exports, nature of the financial system, inflation history of a country. The measurements of exchange rate regime and the econometric model used may not be appropriate to determine the direct relationship between the two variables. High level of inflation could somehow restrain the performance of economies in the region. This confirms the theory of a conflicting relationship between inflation and economic performance. Maintaining a stable macroeconomic environment is a prerequisite for sustained and inclusive development. The study has found that corruption undermines economic performance in one model, thereby confirming the theory on the negative relationship between corruption and economic performance (Fraj and Lachhab, 2015) even if this contradicts the rest of our results where corruption has no effect on growth. Human capital development, proxied by level of education, appears to have no significant impact on growth.

To conclude, the way macroeconomic issues are managed in these countries does not create a climate of confidence among the local and foreign investors. That is why it is important that while opening the economy to external participation, countries should create stable and sound macroeconomic environment, promote financial development and FDI in most productive sectors while diversifying financing by fostering capital markets development, and manage the exchange rate regime carefully to ensure competitiveness, and ultimately attract external funding to sustain long-run growth.

Bibliographic references

Acemoglu, D., Aghion, P. and Zilibotti, F. (2003). Distance to frontier, selection, and economic growth (Working Paper No. 9066). National Bureau of Economic Research. https://doi.org/10.3386/w9066

Acquah, A. M. and Ibrahim, M. (2020). Foreign direct investment, economic growth and financial sector development in Africa. Journal of Sustainable Finance & Investment, 10(4), 315-334. https://doi.org/10.1080/20430795.2019.1683504

Aizenman, J. (1994). Monetary and Real Shocks, Productive Capacity and Exchange Rate Regimes. Economica, 61(244), 407-434. https://doi.org/10.2307/2555031

Alagidede, P. (2008). African stock market integration: implications for portfolio diversification and international risk sharing. In Proceedings of the African Economic Conferences, 25-54.

Alagidede, P. and Ibrahim, M. (2018). Nonlinearities in financial development-economic growth nexus: Evidence from sub-Saharan Africa. Research in International Business and Finance, 46, 95-104. https://doi.org/10.1016/j.ribaf.2017.11.001

Allen, F., Otchere, I. and Senbet, L.W. (2011) African Financial Systems: A Review. Review of Development Finance, 1(2), 79-113. https://hdl.handle.net/10520/EJC89965

Arellano, M. and Bond S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2). 277-297.

Ayenew, B. B. (2022) The effect of foreign direct investment on the economic growth of Sub-Saharan African countries: An empirical approach. Cogent Economics & Finance, 10. https://doi.org/10.1080/23322039.2022.2038862

Barro, R. J. and Lee, J. W. (2015). Education Matters: Global Schooling Gains from the 19th to the 21st Century. Oxford University Press.

Barro R. J., and Sala-i-Martin, X. (1997). Technological Diffusion, Convergence, and Growth. Journal of Economic Growth, 2(1), 1–26.

Barro, R. J. and Sala-i-Martin, X. (2003). Economic Growth (2nd ed.). MIT Press Books.

Beck, T. and Levine, R. (2004). Stock markets, banks and growth: Panel evidence. Journal of Banking & Finance, 28(3), 423–442. https://doi.org/10.1016/S0378-4266(02)00408-9

Bonser-Neal, C. and Tanner G. (1996). Central bank intervention and the volatility of foreign exchange rates: evidence from the options market. Journal of International Money and Finance,15(6), 853-878.

Boyd, J.H.and Smith, B.D. (1992). Intermediation and the equilibrium allocation of investment capital: Implications for economic development. Journal of Monetary Economics, 30(3), 409-432. https://doi.org/10.1016/0304-3932(92)90004-L

Boyd, J. H. and Prescott, E. C. (1986). Financial intermediary-coalitions. Journal of Economic Theory, April 1986, 38(2), 211-232. https://doi.org/10.1016/0022-0531(86)90115-8

Brezigar-Masten, A., Coricelli, F. and Masten, I. (2011). Financial integration and financial development in transition economies: What happens during financial crises?. Economic and Business Review, 13(1), 119-137. https://doi.org/10.15458/2335-4216.1222

Brixiová, Z. and Ncube, M. (2014). The Real Exchange Rate and Growth in Zimbabwe: Does the Currency Regime Matter? (Working Paper No. 1081). William Davidson Institute, University of Michigan.

Bruno, M. (1995), Inflation and growth in an integrated approach. In P. Kenen (Ed.), Understanding Interdependence: The Macroeconomics of the Open Economy. Princeton University Press.

Cecchetti, S. G. and Kharroubi, E. (2012). Reassessing the Impact of Finance on Growth (Working Paper No. 381). Bank for International Settlements.

Chang, C. C. and Mendy, M. (2012) Economic growth and openness in Africa: What is the empirical relationship?. Applied Economics Letters, 19(18), 1903-1907. https://doi.org/10.1080/13504851.2012.676728

Chinn, M. D. and Ito, H. (2005). What matters for financial development? Capital controls, Institutions, and Interactions (Working Paper No. 11370). National Bureau of Economic Research. https://doi.org/10.3386/w11370

Cole, S., Paulson, A. and Shastry, G. K. (2014). Smart Money? The Effect of Education on Financial Outcomes. The Review of Financial Studies, 27(7), 2022-2051. https://doi.org/10.1093/rfs/hhu012

Cull, R. and Effron, L. (2008). World Bank Lending and Financial Sector Development. World Bank Economic Review, 22(2), 315-343. https://doi.org/10.1093/wber/lhn004

Dankyi, A. B., Abban, O. J., Yusheng, K., Coulibaly, T. P. (2022). Human capital, foreign direct investment, and economic growth: Evidence from ECOWAS in a decomposed income level panel. Environmental Challenges, 9. https://doi.org/10.1016/j.envc.2022.100602

David, M. A., Mlachila, M. M. and Moheeput, A. (2014). Does Openness Matter for Financial Development in Africa? (Working Paper No. 14/94). International Monetary Fund.

Fraj, S. H. and Lachhab, A. (2015). Relationship between corruption and economic growth: The case of developing countries. International Journal of Economics, Commerce and Management, 3(9), 862-875.

Frankel, J. (1999). No Single Currency Regime is Right for All Countries or At All Times (Working Paper No. 7338). National Bureau of Economic Research. https://doi.org/10.3386/w7338

Frankel, J. and Rose, A. (2002). An Estimate of the Effect of Common Currencies on Trade and Income. The Quarterly Journal of Economics, 117(2), 437-466. https://doi.org/10.1162/003355302753650292

Goldsmith, R. W. (1969). Financial Structure and Development. Yale University Press.

Grandes, M. and Reisen, H. (2005). Exchange rate regimes and macroeconomic performance in Argentina, Brazil and Mexico. Cepal Review, 86, 7-26. https://hdl.handle.net/11362/11089

Greenwood, J., and Jovanovic, B. (1990). Financial Development, Growth, and the Distribution of Income. Journal of Political Economy, 98(5), 1076-1107.

Grossman, G. and Helpman, E. (1991). Innovation and Growth in the Global Economy. MIT Press.

Gui-Diby, Steve (2014). Impact of foreign direct investments on economic growth in Africa: Evidence from three decades of panel data analyses. Research in Economics, 68(3), 248-256.

Haber, S. H., Razo, A. and Maurer, N. (2003). The Politics of Property Rights: Political Instability, Credible Commitments, and Economic Growth in Mexico, 1876-1929. Cambridge University Press.

Howitt, P. and Aghion, P. (1998). Capital Accumulation and Innovation as Complementary Factors in Long-Run Growth. Journal of Economic Growth, 3(2), 111-130. https://doi.org/10.1023/A:1009769717601

Huchet-Bourdon, M., Le Mouël, C. and Vijil, M. (2013). The relationship between trade openness and economic growth: Some new insights on the openness measurement issue. World Economy, 41(1), 59-76. https://doi.org/10.1111/twec.12586

Jacoby, H. G. (1994). Borrowing constraints and progress through school: Evidence from Peru. Review of Economics and Statistics, 76(1), 151-160. https://doi.org/10.2307/2109833

Jecheche, P. (2011). The effect of stock exchange on economic growth: a case of the Zimbabwe stock exchange. Research in Business and Economics Journal, 6.

Jugurnath, B., Chuckun, N. and Fauzel, S. (2016). Foreign Direct Investment & Economic Growth in Sub-Saharan Africa: An Empirical Study. Theoretical Economics Letters, 6(4), 798-807. https://doi.org/10.4236/tel.2016.64084

Kargbo, S. M. (2017). Foreign Direct Investment and Economic Growth in Africa [Doctoral dissertation, University of Cape Town]. http://hdl.handle.net/11427/25308

Kaufmann, D., Kraay, A. and Mastruzzi, M. (2007). The Worldwide Governance Indicators: Methodology and Analytical Issues. Hague Journal on the Rule of Law, 3(2), 220-246. https://doi.org/10.1017/S1876404511200046

King, R. G., and Levine, R. (1993a). Finance and growth: Schumpeter might be right. Quarterly Journal of Economics, 108(3), 717-738. https://doi.org/10.2307/2118406

King, R. G. and Levine, R. (1993b). Finance, entrepreneurship, and growth: Theory and evidence. Journal of Monetary Economics, 32(3), 513-542. https://doi.org/10.1016/0304-3932(93)90028-E

Klein, M. W. and Olivei, G. P. (2008), Capital account liberalization, financial depth, and economic growth. Journal of International Money and Finance, 27(6), 861-875. https://doi.org/10.1016/j.jimonfin.2008.05.002

Klitgaard, R. E. (1988). Controlling corruption. University of California Press.

Kose, M. A., Prasad, E. S. and Terrones, M. E. (2006). How do trade and financial integration affect the relationship between growth and volatility?. Journal of International Economics, 69(1), 176–202. https://doi.org/10.1016/j.jinteco.2005.05.009

Kose, M. A., Prasad, E. S. and Terrones, M. E. (2009). Does openness to international financial flows raise productivity growth?. Journal of International Money and Finance, 28(4), 554–580. https://doi.org/10.1016/j.jimonfin.2009.01.005

Lamoreaux, N. R. (1994). Insider Lending: Banks, Personal Connections, and Economic Development in Industrial New England. Cambridge University Press.

Levine, R., Loayza, N. and Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31-77. https://doi.org/10.1016/S0304-3932(00)00017-9

Levine, R., and Zervos, S. (1998). Stock Markets, Banks, and Economic Growth. American Economic Review, 88(3), 537-558.

Levy-Yeyati, E. and Sturzenegger, F. (2003). A de facto Classification of Exchange Rate Regimes: A Methodological Note [Notes]. Sturzenegger personal website.

Levy-Yeyati, E. and Sturzenegger, F. (2005). Classifying exchange rate regimes: Deeds vs. words. European Economic Review, 9(6), 1603-1635. https://doi.org/10.1016/j.euroecorev.2004.01.001

Maduka, A. C. and Onwuka, K. O. (2013). Financial Market Structure and Economic Growth: Evidence from Nigeria Data. Asian Economic and Financial Review, 3(1), 75-98.

Masson, P. and Pattillo, C. (2005). The Monetary Geography of Africa. Brookings Institution Press.

Meade, J. (1951). The Theory of International Economic Policy. Oxford University Press.

Meier, G. M., Bauer, P. T. and Seers, D. (1984). Pioneers in Development. A World Bank Research Publication.

Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information. Journal of Finance, 42(3), 483-510. https://doi.org/10.1111/j.1540-6261.1987.tb04565.x

Morck, R., Wolfenzon, D. and Yeung, B. (2005). Corporate governance, economic entrenchment and growth. Journal of Economic Literature, 43(3), 655-720. https://doi.org/10.1257/002205105774431252

Morck, R., Yeung, B. and Yu, W. (2000). The information content of stock markets: Why do emerging markets have synchronous stock price movements?. Journal of Financial Economics, 58(1-2), 215-260. https://doi.org/10.1016/S0304-405X(00)00071-4

Nnanna, O.J. (2002). Monetary Policy and Exchange Rate Stability in Nigeria. Economic and Financial Review, 40(3), 1-21.

Obstfeld M., and K. Rogoff, K. (1994). Exchange Rate Dynamics Redux (Working Paper No. 4693). National Bureau of Economic Research. https://doi.org/10.3386/w4693

OECD (2002). Foreign direct investment for development: Maximising benefits, minimising costs.

Ojo, M. O. (1990). The Management of Foreign Exchange Resources in Nigeria. Economic and Financial Review, 28(3).

Omri, A. and Kahouli, B. (2013). The nexus among foreign investment, domestic capital and economic growth: Empirical evidence from the MENA region. Research in Economics, 68(3), 257-263. https://doi.org/10.1016/j.rie.2013.11.001

Otchere, I., Soumaré, I. and Yourougou, P. (2016). FDI and Financial Market Development in Africa. World Economy, 39(5), 651-678. https://doi.org/10.1111/twec.12277

Owusu, E. L. and Odhiambo, N. (2013). Financial liberalization and economic growth in Ivory Coast: an empirical investigation. Investment Management and Financial Innovations, 10(4), 171-180.

Prasad, E., Rogoff, K., Wei, S. J. and Kose, M. A. (2005), Effects of Financial Globalization on Developing Countries: Some Empirical Evidence. In W. Tseng and D. Cowen (eds.) India’s and China’s Recent Experience with Reform and Growth. Procyclicality of Financial Systems in Asia. Palgrave Macmillan. https://doi.org/10.1057/9780230505759_9

PwC. (2017). 2016 Africa Capital Markets Watch .

Rivera-Batiz, L. A. and Romer, P. M. (1991). International trade with endogenous technological change. European Economic Review, 35(4), 971-1001. https://doi.org/10.1016/0014-2921(91)90048-N

Rousseau, P. L. and Wachtel, P. (1998). Financial intermediation and economic performance: Historical evidence from five industrial countries. Journal of Money, Credit and Banking, 30(4), 657-678. https://doi.org/10.2307/2601123

Schmidt-Hebbel, K., Servén, L., and Solimano, A. (1996). Saving and Investment: Paradigms, Puzzles, Policies. World Bank Research Observer, 11(1), 87-117. https://doi.org/10.1093/wbro/11.1.87

Simwaka, K. (2010). Choice of exchange rate regimes for African countries: Fixed or Flexible Exchange rate regimes? (Working Paper 23129). Munich Personal RePEc Archive.

Solow, R. M. (1956). A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics, 70(1), 65-94. https://doi.org/10.2307/1884513

Sosvilla-Rivero, S. and Ramos-Herrera, M. C. (2014). Exchange-rate regimes and economic growth: an empirical evaluation. Applied Economics Letters, 21(12), 870-873. https://doi.org/10.1080/13504851.2014.894625

Stotsky, J. G., Ghazanchyan, M., Adedeji, O. and Maehle, N. (2012). The Relationship between the Foreign Exchange Regime and Macroeconomic Performance in Eastern Africa (Working Paper 12/148). International Monetary Fund.

Tsangarides, C. G., and Qureshi, M. S. (2008). Monetary Union Membership in West Africa: A Cluster Analysis. World Development, 36(7), 1261-1279. https://doi.org/10.1016/j.worlddev.2007.06.019

World Bank (2016). World Development Indicators [Data file].

World Bank (2017). Global Financial Development Report 2017/2018: Bankers without Borders [Data file]. https://doi.org/10.1596/978-1-4648-1148-7

World Bank (2021). Global Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial Crisis [Data file]. https://doi.org/10.1596/978-1-4648-1447-1

Yartey, C. A. and Adjasi, C. K. (2007). Stock Market Development in Sub-Saharan Africa: Critical Issues and Challenges (Working Paper 07/209). International Monetary Fund.

Annex

Notes